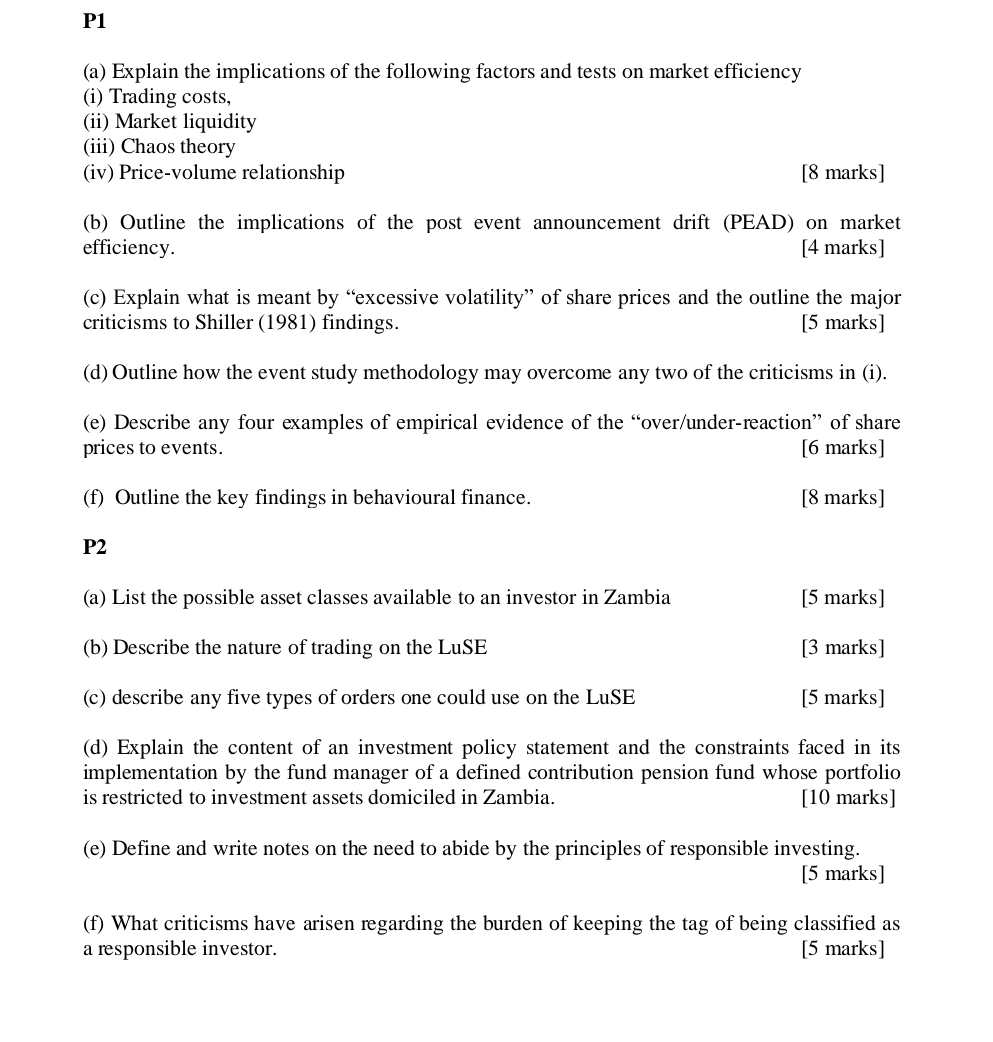

Question: P 1 ( a ) Explain the implications of the following factors and tests on market efficiency ( i ) Trading costs, ( ii )

P

a Explain the implications of the following factors and tests on market efficiency

i Trading costs,

ii Market liquidity

iii Chaos theory

iv Pricevolume relationship

marks

b Outline the implications of the post event announcement drift PEAD on market

efficiency.

marks

c Explain what is meant by "excessive volatility" of share prices and the outline the major

criticisms to Shiller findings.

marks

d Outline how the event study methodology may overcome any two of the criticisms in i

e Describe any four examples of empirical evidence of the "overunderreaction" of share

prices to events.

marks

f Outline the key findings in behavioural finance.

marks

P

a List the possible asset classes available to an investor in Zambia

marks

b Describe the nature of trading on the LuSE

marks

c describe any five types of orders one could use on the LuSE

marks

d Explain the content of an investment policy statement and the constraints faced in its

implementation by the fund manager of a defined contribution pension fund whose portfolio

is restricted to investment assets domiciled in Zambia.

e Define and write notes on the need to abide by the principles of responsible investing.

marks

f What criticisms have arisen regarding the burden of keeping the tag of being classified as

a responsible investor.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock