Question: P . 1 Two large retail chains that we will call Red and Green are aggressively expanding across the US cities. For every city where

P

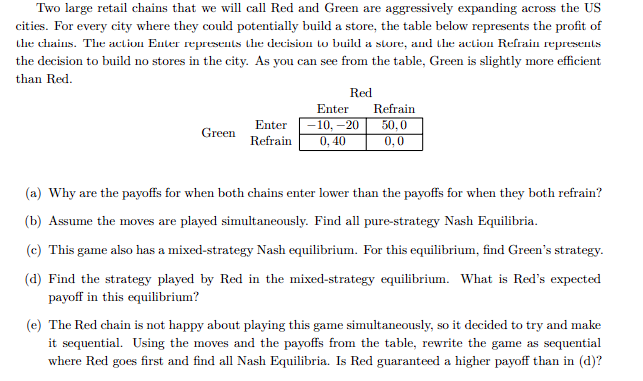

Two large retail chains that we will call Red and Green are aggressively

expanding across the US

cities. For every city where they could potentially build a store, the table below represents the profit of

the chains. The action Enter represents the decision to build a store, and the action Refrain represents

the decision to build no stores in the city. As you can see from the table, Green is slightly more efficient

than Red.

a Why are the payoffs for when both chains enter lower than the payoffs for when they both refrain?

b Assume the moves are played simultaneously. Find all purestrategy Nash Equilibria.

c This game also has a mixedstrategy Nash equilibrium. For this equilibrium, find Green's strategy.

d Find the strategy played by Red in the mixedstrategy equilibrium. What is Red's expected

payoff in this equilibrium?

e The Red chain is not happy about playing this game simultaneously, so it decided to try and make

it sequential. Using the moves and the payoffs from the table, rewrite the game as sequential

where Red goes first and find all Nash Equilibria. Is Red guaranteed a higher payoff than in d

P

Black and Blue are trading partners separated by the ocean: Black is in the US and Blue is in

China. Every year, they can choose to Cooperate with each other or to Betray, and the matrix of

annual payoffs is provided below. Cooperation represents honoring the contracts that the firms have

signed with each other, while Betrayal involves reneging on old deals or underpaying for the services.

The annual time discount is delta so that $ next period of time is worth $delta today in expectation.

a If delta what outcomes are possible in Nash equilibrium in this game? Explain.

b Suppose delta and the game is repeated infinitely. If Black and Blue somehow manage to

repeatedly choose to Cooperate, what is the expected payoff from the game to either firm?

c Suppose both firms are playing grim trigger strategies. For what values of delta can they maintain

the cooperative outcome?

d Some argue that when relations between countries grow tense and uncertain, it changes the

value of delta from the perspective of the firms playing games of cooperation. How would increasing

uncertainty in international relations affect delta assuming the interest rates are fixed How would

this change affect the ability of the firms to maintain the cooperative outcome?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock