Question: P 12-12 (book/static) : Question Help The following table contains monthly returns for Cola Co. and Gas Co. for 2010 (the returns are shown in

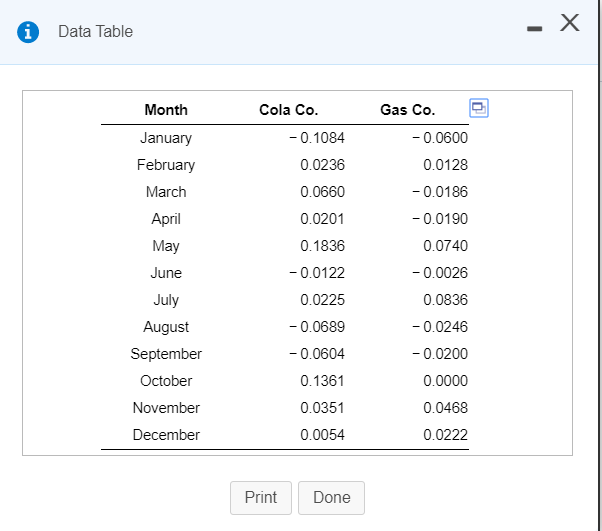

P 12-12 (book/static) : Question Help The following table contains monthly returns for Cola Co. and Gas Co. for 2010 (the returns are shown in decimal form, i.e., 0.035 is 3.5%). Using this table and the fact that Cola Co. and Gas Co. have a correlation of 0.6084, calculate the volatility (standard deviation) of a portfolio that is 55% invested in Cola Co. stock and 45% invested in Gas Co. stock. Calculate the volatility by: a. Using the formula: Var(Ro) = w; SD (R1) 2 + w SD (R2) +2W, W2 Corr (R1,R2) SD (R1) SD (R2) b. Calculating the monthly returns of the portfolio and computing its volatility directly. c. How do your results compare? a. Using the formula: Var(Ro) = w; SD (R1) 2 + w SD (R2) +2W, W2 Corr (R1,R2) SD (R1) SD (R2) The volatility (standard deviation) of the portfolio is %. (Round to two decimal places.) Data Table Month January February March April May June July August September October November December Cola Co. - 0.1084 0.0236 0.0660 0.0201 0.1836 -0.0122 0.0225 -0.0689 -0.0604 0.1361 0.0351 0.0054 Gas Co. -0.0600 0.0128 -0.0186 -0.0190 0.0740 -0.0026 0.0836 -0.0246 -0.0200 0.0000 0.0468 0.0222 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts