Question: P 12-9: Prepare a statement of cash flows using the indirect method, following the T The condensed financial data of Granger Inc. are presented below:

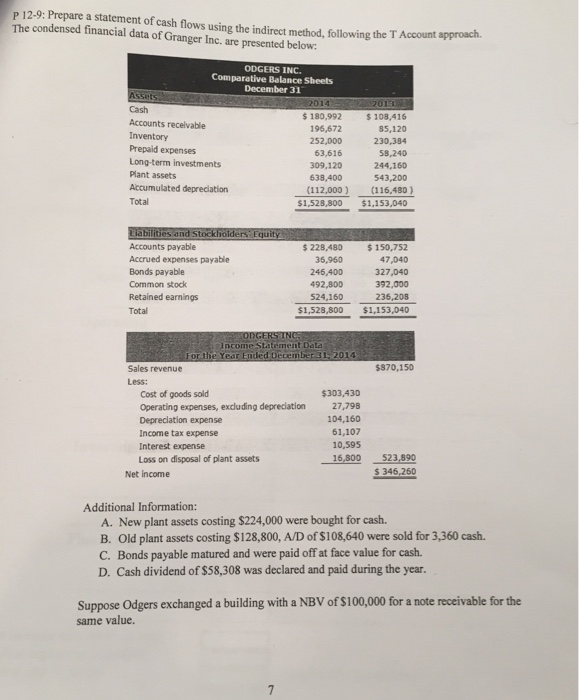

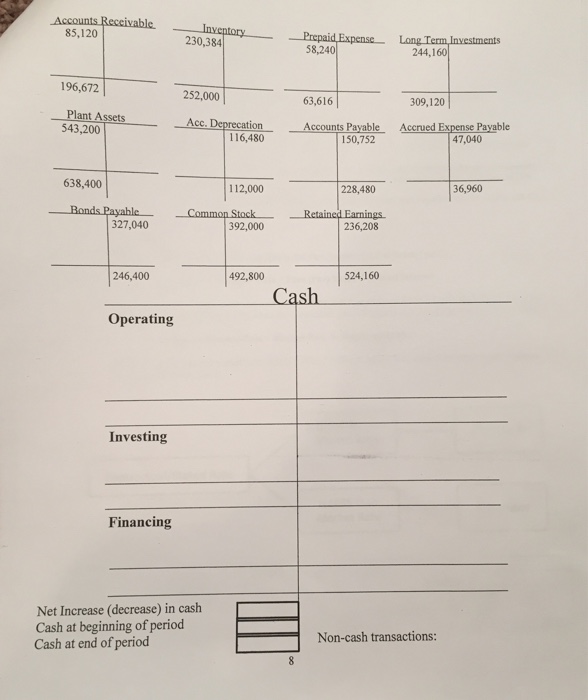

P 12-9: Prepare a statement of cash flows using the indirect method, following the T The condensed financial data of Granger Inc. are presented below: ODGERS INC. Comparative Balance Sheets December 31 Cash Accounts recelvable Inventory Prepaid expenses Long-term investments Plant assets Accumulated depreclation Total $180,992 196,672 63,616 S 108,416 85,120 252,000 230,384 58,240 309,120 43,200 244,160 638,400 (112,000) (116,480 ) $1,528,800 $1,153,040 Accounts payable Accrued expenses payable Bonds payable Common stock Retained earnings Total $228,480 150,752 47,040 36,960 246,400 492,800 524,160 392,000 236,208 $1,528,800 $1,153,040 Income Statement For the Yeor Ended December 31: 2014 $870,150 Sales revenue Less: Cost of goods sold Operating expenses, excduding depreciation $303.430 27,798 104,160 61,107 10,595 Income tax expense Interest expense Loss on disposal of plant assets 16,800 523,990 346,260 Net income Additional Information: A. New plant assets costing $224,000 were bought for cash B. Old plant assets costing $128,800, A/D of $108,640 were sold for 3,360 cash. C. Bonds payable matured and were paid off at face value for cash D. Cash dividend of $58,308 was declared and paid during the year Suppose Odgers exchanged a building with a NBV of $100,000 for a note receivable for the same value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts