Question: P 2 - 3 Initial public offering In June 2 0 1 9 , Forgefast PLC completed its IPO on Alternative Investment Market ( AIM

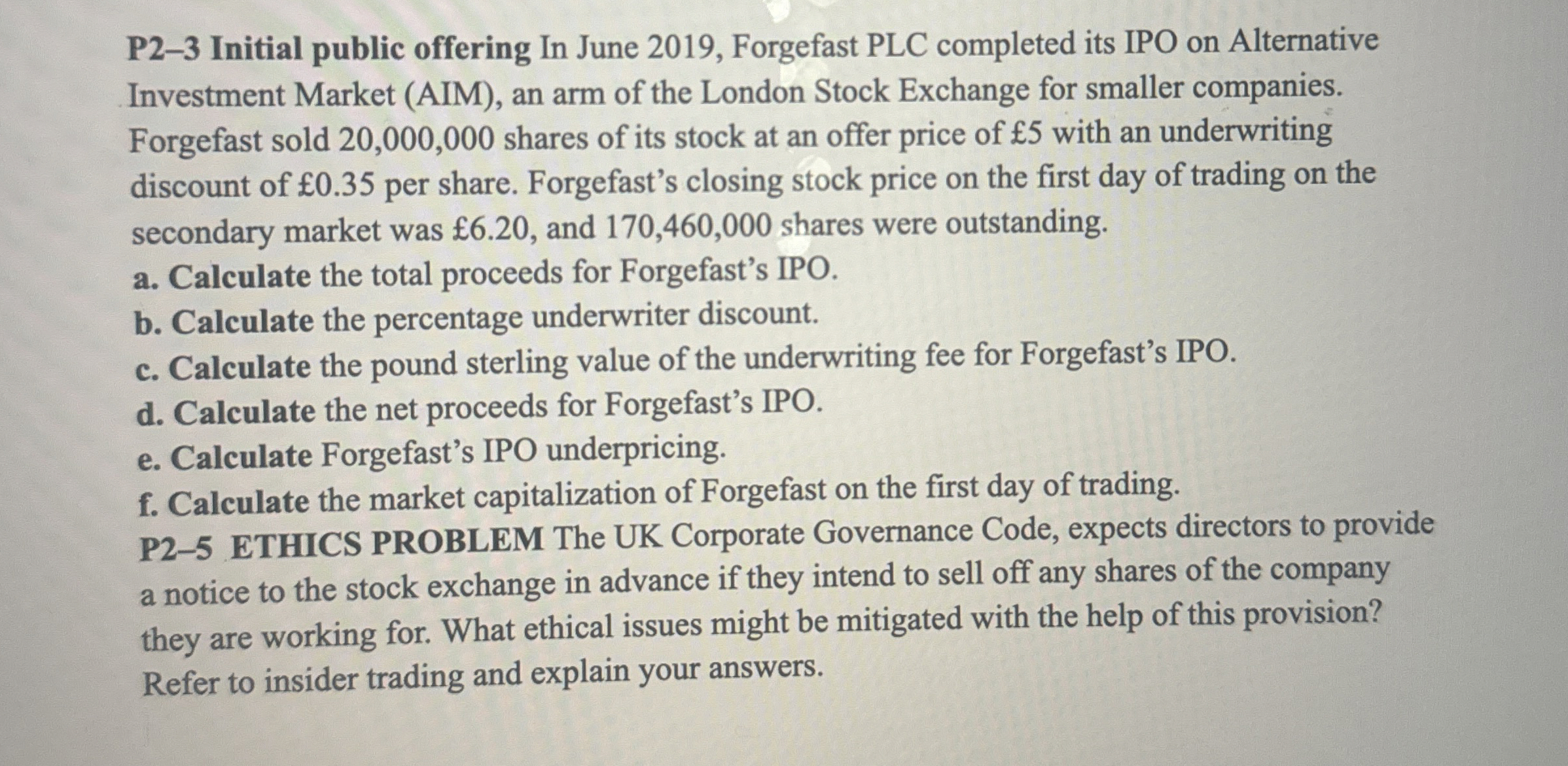

P Initial public offering In June Forgefast PLC completed its IPO on Alternative Investment Market AIM an arm of the London Stock Exchange for smaller companies. Forgefast sold shares of its stock at an offer price of with an underwriting discount of per share. Forgefasts closing stock price on the first day of trading on the secondary market was and shares were outstanding.

a Calculate the total proceeds for Forgefast's IPO.

b Calculate the percentage underwriter discount.

c Calculate the pound sterling value of the underwriting fee for Forgefast's IPO.

d Calculate the net proceeds for Forgefast's IPO.

e Calculate Forgefast's IPO underpricing.

f Calculate the market capitalization of Forgefast on the first day of trading.

P ETHICS PROBLEM The UK Corporate Governance Code, expects directors to provide a notice to the stock exchange in advance if they intend to sell off any shares of the company they are working for. What ethical issues might be mitigated with the help of this provision? Refer to insider trading and explain your answers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock