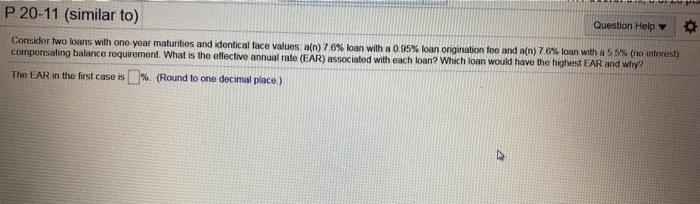

Question: P 20-11 (similar to) Question Help Consider two loans with one year maturities and dentical face values a(n) 76% loan with a 0.85% loan origination

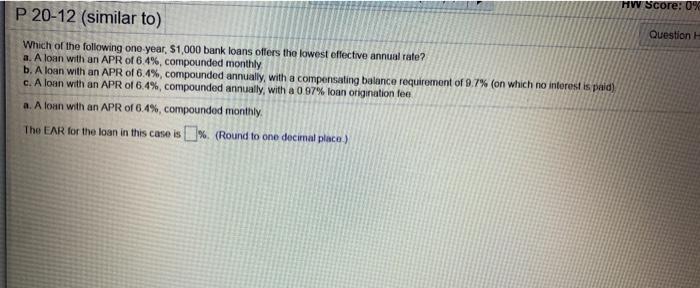

P 20-11 (similar to) Question Help Consider two loans with one year maturities and dentical face values a(n) 76% loan with a 0.85% loan origination too and a(n) 78% loan with a 55% (no anterest) compensating balance requirement. What is the effective annual rate (EAR) associated with each loan? Which loan would have the highest EAR and why? The EAR in the first case is %. (Round to one decimal place) HV Score: 0% P 20-12 (similar to) Question Which of the following one year, $1,000 bank loans offers the lowest effective annual rate? a. A loan with an APR of 6.4%, compounded monthly b. A loan with an APR of 6.4%, compounded annually, with a compensating balance requirement of 9.7% (on which no interest is paid) c. A loan with an APR of 6.4%, compounded annually, with a 0 97% loan origination fee a. A loan with an APR of 6.4%, compounded monthly The EAR for the loan in this case is [%. (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts