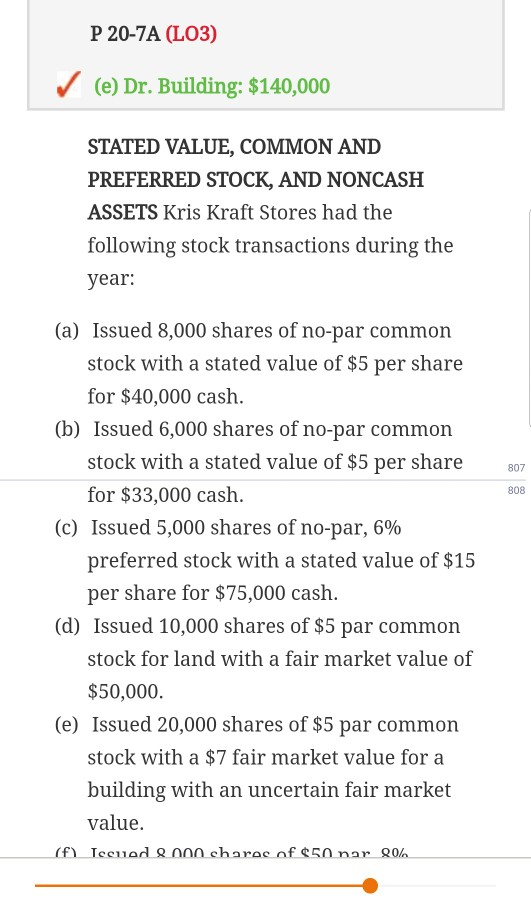

Question: P 20-7A (L03) (e) Dr. Building: $140,000 STATED VALUE, COMMON AND PREFERRED STOCK, AND NONCASH ASSETS Kris Kraft Stores had the following stock transactions during

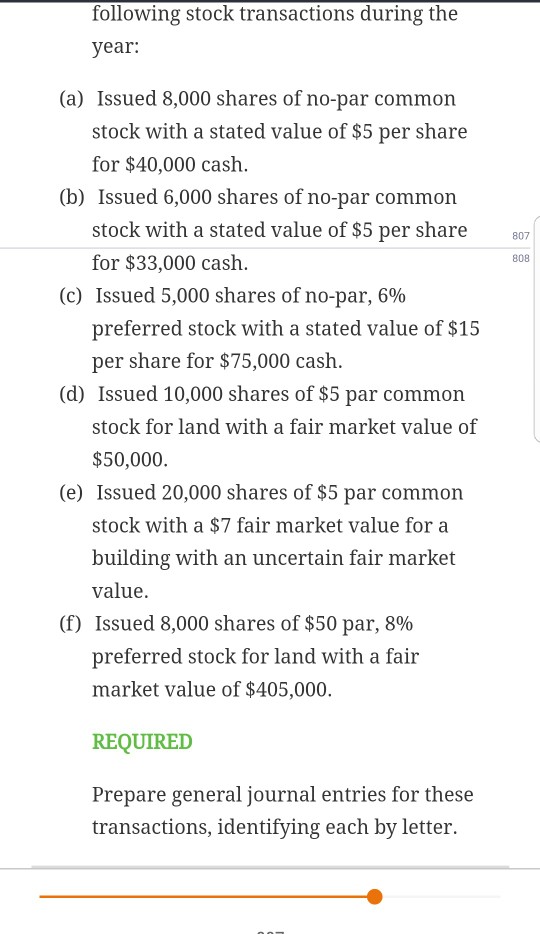

P 20-7A (L03) (e) Dr. Building: $140,000 STATED VALUE, COMMON AND PREFERRED STOCK, AND NONCASH ASSETS Kris Kraft Stores had the following stock transactions during the year (a) Issued 8,000 shares of no-par common stock with a stated value of $5 per share for $40,000 cash (b) Issued 6,000 shares of no-par common stock with a stated value of $5 per share for $33,000 cash Issued 5,000 shares of no-par, 6% preferred stock with a stated value of $15 per share for $75,000 cash 807 808 (c) (d) Issued 10,000 shares of $5 par common stock for land with a fair market value of $50,000 (e) Issued 20,000 shares of $5 par common stock with a $7 fair market value for a building with an uncertain fair market value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts