Question: P 3-2 Allocation schedule for fair value/book value differential and consolidated bal- ance sheet at acquisition Par Corporation acquired 70 percent of the outstanding common

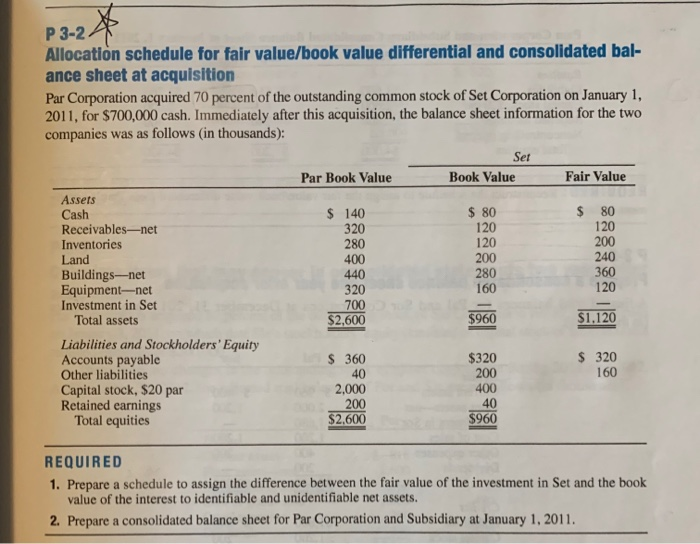

P 3-2 Allocation schedule for fair value/book value differential and consolidated bal- ance sheet at acquisition Par Corporation acquired 70 percent of the outstanding common stock of Set Corporation on January 1, 2011, for $700,000 cash. Immediately after this acquisition, the balance sheet information for the two companies was as follows (in thousands): Set Fair Value Par Book Value Book Value Assets Cash Receivables-net Inventories $ 80 120 200 $ 80 120 120 $ 140 320 280 400 440 320 240 360 120 200 280 160 Land Buildings-net Equipment-net Investment in Set Total assets 700 $1.120 $960 $2,600 Liabilities and Stockholders' Equity Accounts payable Other liabilities $ 320 160 $ 360 40 2,000 200 $320 200 400 40 $960 Capital stock, $20 par Retained earnings Total equities $2.600 REQUIRED 1. Prepare a schedule to assign the difference between the fair value of the investment in Set and the book value of the interest to identifiable and unidentifiable net assets. 2. Prepare a consolidated balance sheet for Par Corporation and Subsidiary at January 1, 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts