Question: P 5 - 3 5 . Analyzing and Interpreting Income Tax Disclosures ( LO 3 ) The 2 0 1 2 income statement for Plizer

P Analyzing and Interpreting Income Tax Disclosures LO

The income statement for Plizer Inc. is reproduced in this module. Pfizer also reports the following

footnote relating to its income taxes in its report.

Module I Reporting and Analyzing Operating Income

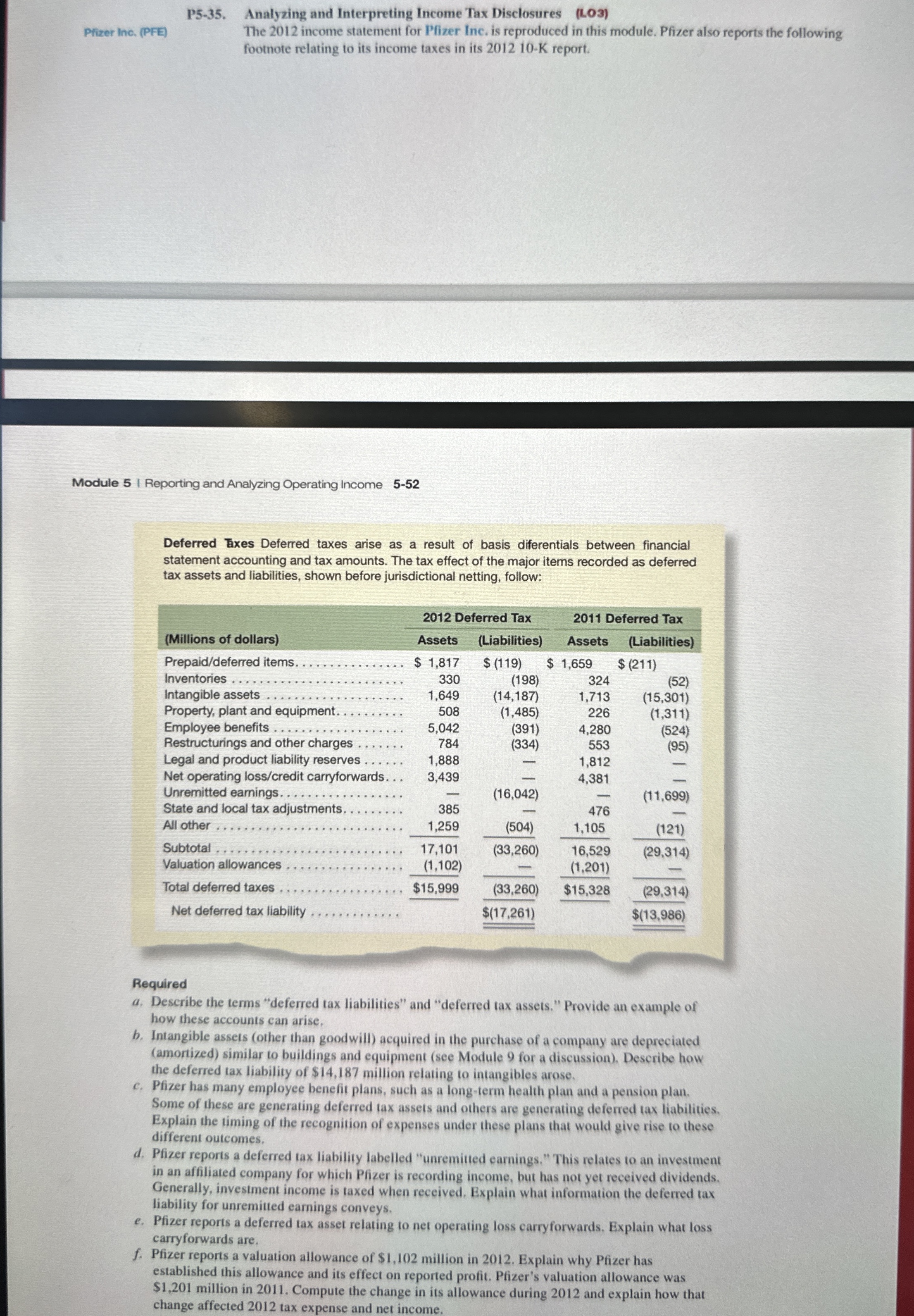

Deferred Gxes Deferred taxes arise as a result of basis diferentials between financial

statement accounting and tax amounts. The tax effect of the major items recorded as deferred

tax assets and liabilities, shown before jurisdictional netting, follow:

Required

a Describe the terms "deferred tax liabilities" and "deferred tax assets." Provide an example of

how these accounts can arise.

b Intangible assets other than goodwill acquired in the purchase of a company are depreciated

amortized similar to buildings and equipment see Module for a discussion Describe how

the deferred tax liability of $ million relating to intangibles arose.

c Pfizer has many employee benefit plans, such as a longterm health plan and a pension plan.

Some of these are generating deferred tax assets and others are generating deferred tax liabilities.

Explain the timing of the recognition of expenses under these plans that would give rise to these

different outcomes.

d Pfizer reports a deferred tax liability labelled "unremitted earnings." This relates to an investment

in an affiliated company for which Pfizer is recording income, but has not yet received dividends.

Generally, investment income is taxed when received. Explain what information the deferred tax

liability for unremitted earnings conveys.

e Pfizer reports a deferred tax asset relating to net operating loss carryforwards. Explain what loss

carryforwards are.

f Pfizer reports a valuation allowance of $ million in Explain why Pfizer has

established this allowance and its effect on reported profit. Pfizer's valuation allowance was

$ million in Compute the change in its allowance during and explain how that

change affected tax expense and net income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock