Question: P 6 - 2 5 Multiple Inventory Transfers between Parent and Subsidiary Proud Company and Slinky Company both produce and purchase equipment for resale each

P Multiple Inventory Transfers between Parent and Subsidiary

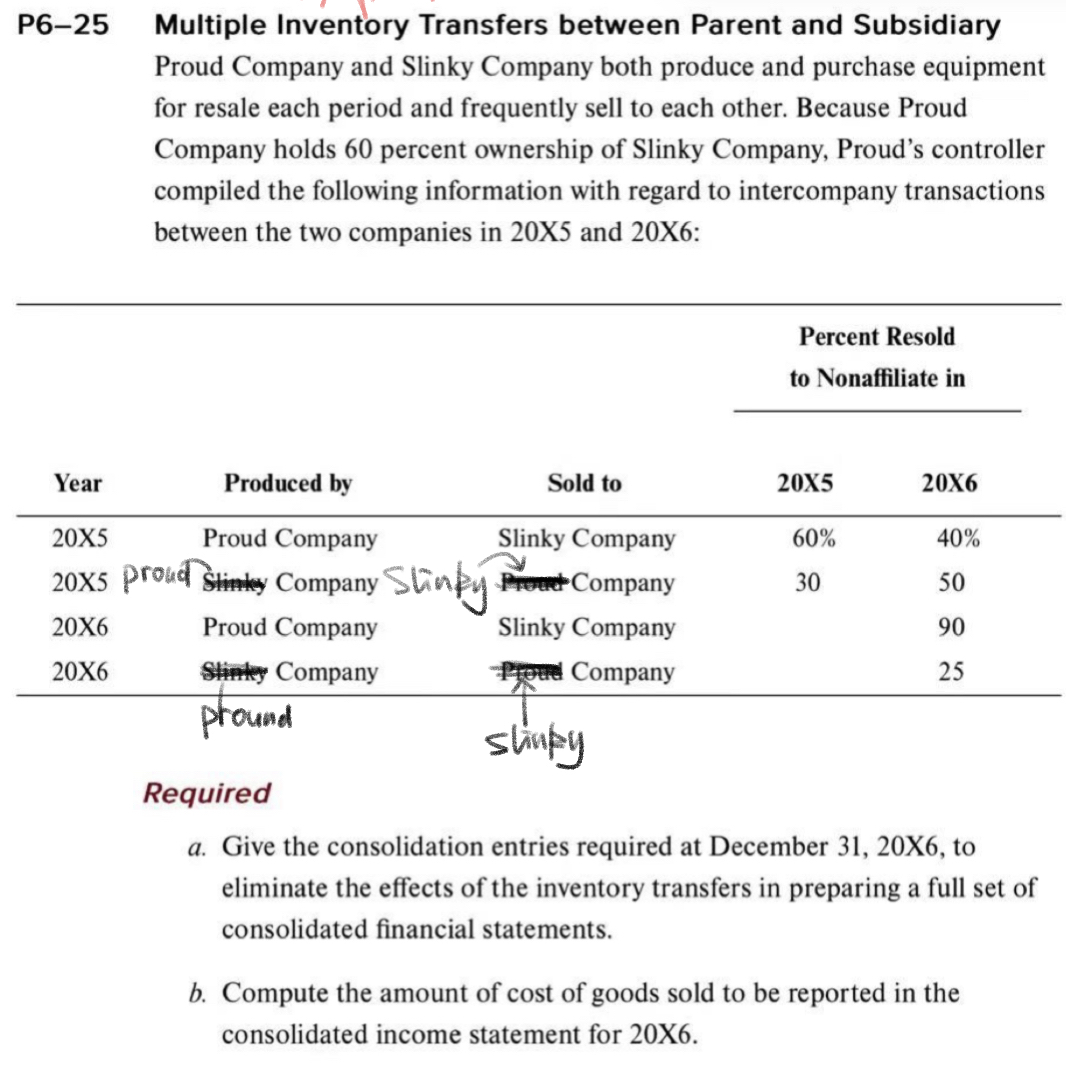

Proud Company and Slinky Company both produce and purchase equipment for resale each period and frequently sell to each other. Because Proud Company holds percent ownership of Slinky Company, Proud's controller compiled the following information with regard to intercompany transactions between the two companies in X and X:

tableYearProduced bySold toPercent Resold to Nonaffiliate inXXXProud Company,Slinky Company,XStinky Company,Prout Company,XProud Company,Slinky Company,,XStimy Company,Pyet Company,,pround,sunpy,,

Required

a Give the consolidation entries required at December X to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b Compute the amount of cost of goods sold to be reported in the consolidated income statement for XP Multiple Inventory Transfers between Parent and Subsidiary

Proud Company and Slinky Company both produce and purchase equipment for resale each period and frequently sell to each other. Because Proud Company holds percent ownership of Slinky Company, Proud's controller compiled the following information with regard to intercompany transactions between the two companies in X and X:

tableYearProduced bySold toPercent Resold to Nonaffiliate inXXXProud Company,Slinky Company,XStinky Company,Prout Company,XProud Company,Slinky Company,,XStimy Company,Pyet Company,,pround,sunpy,,

Required

a Give the consolidation entries required at December X to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b Compute the amount of cost of goods sold to be reported in the consolidated income statement for XP Multiple Inventory Transfers between Parent and Subsidiary

Proud Company and Slinky Company both produce and purchase equipment for resale each period and frequently sell to each other. Because Proud Company holds percent ownership of Slinky Company, Proud's controller compiled the following information with regard to intercompany transactions between the two companies in X and X:

tableYearProduced bySold toPercent Resold to Nonaffiliate inXXXProud Company,Slinky Company,XStinky Company,Prout Company,XProud Company,Slinky Company,,XStimy Company,Pyet Company,,pround,sunpy,,

Required

a Give the consolidation entries required at December X to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b Compute the amount of cost of goods sold to be reported in the consolidated income statement for XP Multiple Inventory Transfers between Parent and Subsidiary

Proud Company and Slinky Company both produce and purchase equipment for resale each period and frequently sell to each other. Because Proud Company holds percent ownership of Slinky Company, Proud's controller compiled the following information with regard to intercompany transactions between the two companies in X and X:

tableYearProduced bySold toPercent Resold to Nonaffiliate inXXXProud Company,Slinky Company,XStinky Company,Prout Company,XProud Company,Slinky Company,,XStimy Company,Pyet Company,,pround,sunpy,,

Required

a Give the consolidation entries required at December X to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b Compute the amount of cost of goods sold to be reported in the consolidated income statement for XP Multiple Inventory Transfers between Parent and Subsidiary

Proud Company and Slinky Company both produce and purchase equipment for resale each period and frequently sell to each other. Because Proud Company holds percent ownership of Slinky Company, Proud's controller compiled the following information with regard to intercompany transactions between the two companies in X and X:

tableYearProduced bySold toPercent Resold to Nonaffiliate inXXXProud Company,Slinky Company,XStinky Company,Prout Company,XProud Company,Slinky Company,,XStimy Company,Pyet Company,,pround,sunpy,,

Required

a Give the consolidation entries required at December X to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b Compute the amount of cost of goods sold to be reported in the consolidated income statement for XP Multiple Inventory Transfers between Parent and Subsidiary

Proud Company and Slinky Company both produce and purchase equipment for resale each period and frequently sell to each other. Because Proud Company holds pe

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock