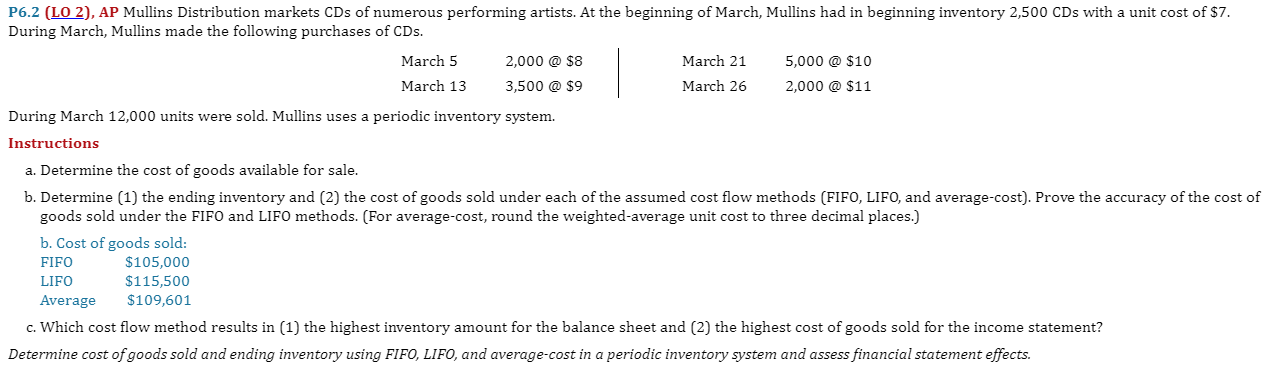

Question: P 6 . 2 ( LO 2 ) , AP Mullins Distribution markets CDs of numerous performing artists. At the beginning of March, Mullins had

PLO AP Mullins Distribution markets CDs of numerous performing artists. At the beginning of March, Mullins had in beginning inventory CDs with a unit cost of $ During March, Mullins made the following purchases of CDs PLO AP Mullins Distribution markets CDs of numerous performing artists. At the beginning of March, Mullins had in beginning inventory CDs with a unit cost of $

During March, Mullins made the following purchases of CDs

During March units were sold. Mullins uses a periodic inventory system.

Instructions

a Determine the cost of goods available for sale.

b Determine the ending inventory and the cost of goods sold under each of the assumed cost flow methods FIFO LIFO, and averagecost Prove the accuracy of the cost of

goods sold under the FIFO and LIFO methods. For averagecost round the weightedaverage unit cost to three decimal places.

b Cost of goods sold:

FIFO $

LIFO $

Average $

c Which cost flow method results in the highest inventory amount for the balance sheet and the highest cost of goods sold for the income statement?

Determine cost of goods sold and ending inventory using FIFO, LIFO, and averagecost in a periodic inventory system and assess financial statement effects.

March @ $ March @ $

March @ $ March @ $

During March units were sold. Mullins uses a periodic inventory system.

Instructions

Determine the cost of goods available for sale.

Determine the ending inventory and the cost of goods sold under each of the assumed cost flow methods FIFO LIFO, and averagecost Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. For averagecost round the weightedaverage unit cost to three decimal places.

b Cost of goods sold:

FIFO $

LIFO $

Average $

Which cost flow method results in the highest inventory amount for the balance sheet and the highest cost of goods sold for the income statement?

Determine cost of goods sold and ending inventory using FIFO, LIFO, and averagecost in a periodic inventory system and assess financial statement effects.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock