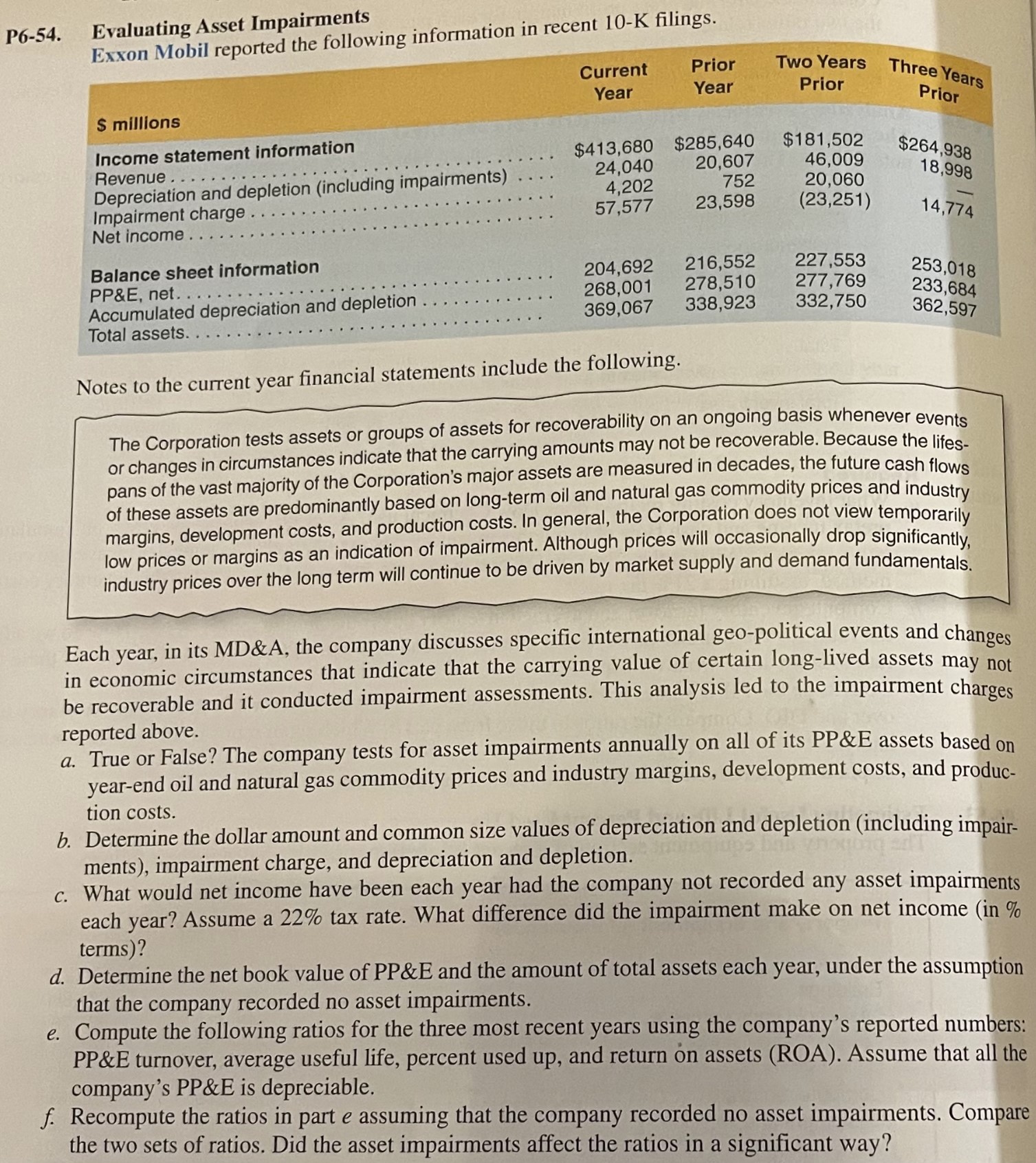

Question: P 6 - 5 4 . Evaluating Asset Impairments Exxon Mobil reported the following information in recent ( 1 0 - mathrm {

P Evaluating Asset Impairments

Exxon Mobil reported the following information in recent mathrmK filings.

Notes to the current year financial statements include the following.

The Corporation tests assets or groups of assets for recoverability on an ongoing basis whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable. Because the lifespans of the vast majority of the Corporation's major assets are measured in decades, the future cash flows of these assets are predominantly based on longterm oil and natural gas commodity prices and industry margins, development costs, and production costs. In general, the Corporation does not view temporarily low prices or margins as an indication of impairment. Although prices will occasionally drop significantly, industry prices over the long term will continue to be driven by market supply and demand fundamentals.

Each year, in its MD&A the company discusses specific international geopolitical events and changes in economic circumstances that indicate that the carrying value of certain longlived assets may not be recoverable and it conducted impairment assessments. This analysis led to the impairment charges reported above.

a True or False? The company tests for asset impairments annually on all of its PP&E assets based on yearend oil and natural gas commodity prices and industry margins, development costs, and production costs.

b Determine the dollar amount and common size values of depreciation and depletion including impairments impairment charge, and depreciation and depletion.

c What would net income have been each year had the company not recorded any asset impairments each year? Assume a tax rate. What difference did the impairment make on net income in terms

d Determine the net book value of mathrmPP& mathrmE and the amount of total assets each year, under the assumption that the company recorded no asset impairments.

e Compute the following ratios for the three most recent years using the company's reported numbers: PP&E turnover, average useful life, percent used up and return on assets ROA Assume that all the company's PP&E is depreciable.

f Recompute the ratios in part e assuming that the company recorded no asset impairments. Compare the two sets of ratios. Did the asset impairments affect the ratios in a significant way?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock