Question: P 7 - 4 ( Bad - Debt Reporting ) From inception of operations to December 3 1 , 2 0 1 0 , Fortner

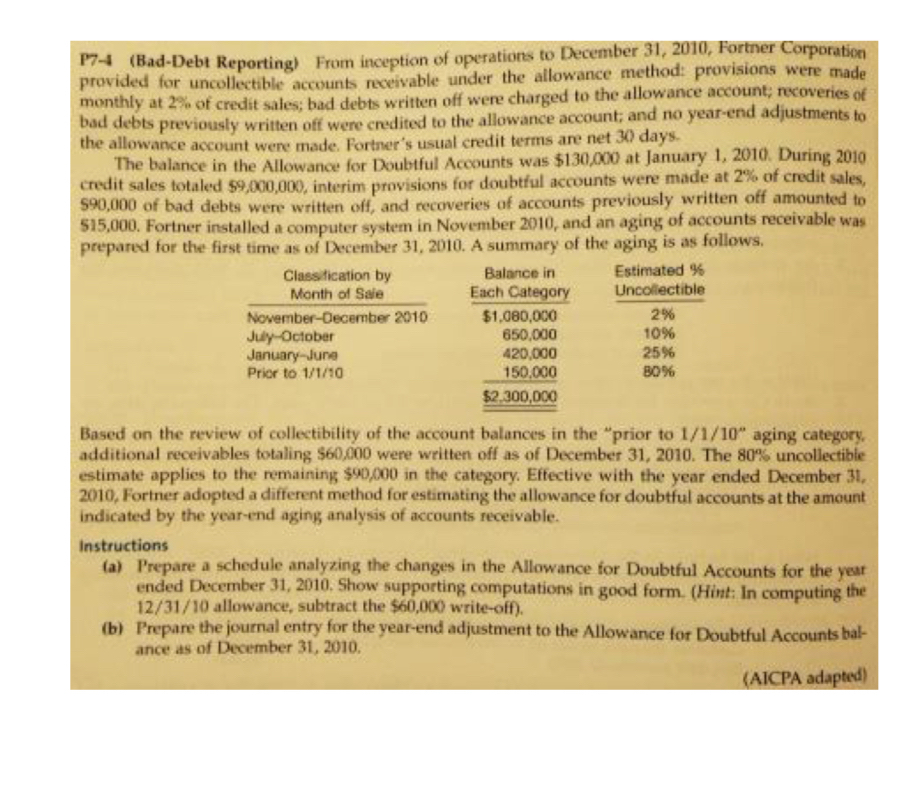

PBadDebt Reporting From inception of operations to December Fortner Corporation provided for uncollectible accounts receivable under the allowance method: provisions were made monthly at of credit sales; bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no yearend adjustments to the allowance account were made. Fortner's usual credit terms are net days.

The balance in the Allowance for Doubtful Accounts was $ at January During credit sales totaled $ interim provisions for doubtful accounts were made at of credit sales, $ of bad debts were written off, and recoveries of accounts previously written off amounted to $ Fortner installed a computer system in November and an aging of accounts receivable was prepared for the first time as of December A summary of the aging is as follows.

tabletableClassitication byMonth of SaletableBalance inEach CategorytableEstimated UncollectibleNovemberDecember $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock