Question: P 8 - 2 9 . Depreciation - declining - balance method ( L . O . 8 - 2 ) ( Easy -

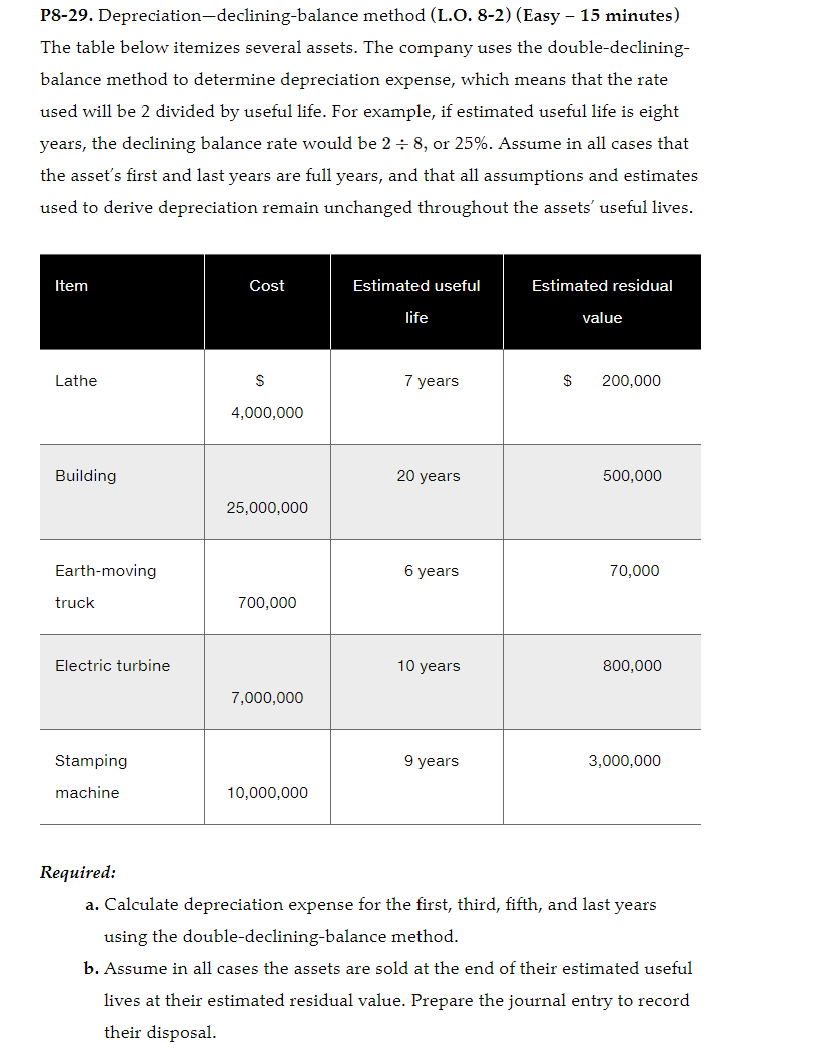

P Depreciationdecliningbalance method LOEasy mathbf minutes The table below itemizes several assets. The company uses the doubledecliningbalance method to determine depreciation expense, which means that the rate used will be divided by useful life. For example, if estimated useful life is eight years, the declining balance rate would be div or Assume in all cases that the asset's first and last years are full years, and that all assumptions and estimates used to derive depreciation remain unchanged throughout the assets' useful lives.

begintabularcccc

hline Item & Cost & Estimated useful life & Estimated residual value

hline Lathe &

beginarrayc

$

endarray

& years & $

hline Building & & years &

hline Earthmoving truck & & years &

hline Electric turbine & & years &

hline Stamping machine & & years &

hline

endtabular

Required:

a Calculate depreciation expense for the first, third, fifth, and last years using the doubledecliningbalance method.

b Assume in all cases the assets are sold at the end of their estimated useful lives at their estimated residual value. Prepare the journal entry to record their disposal.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock