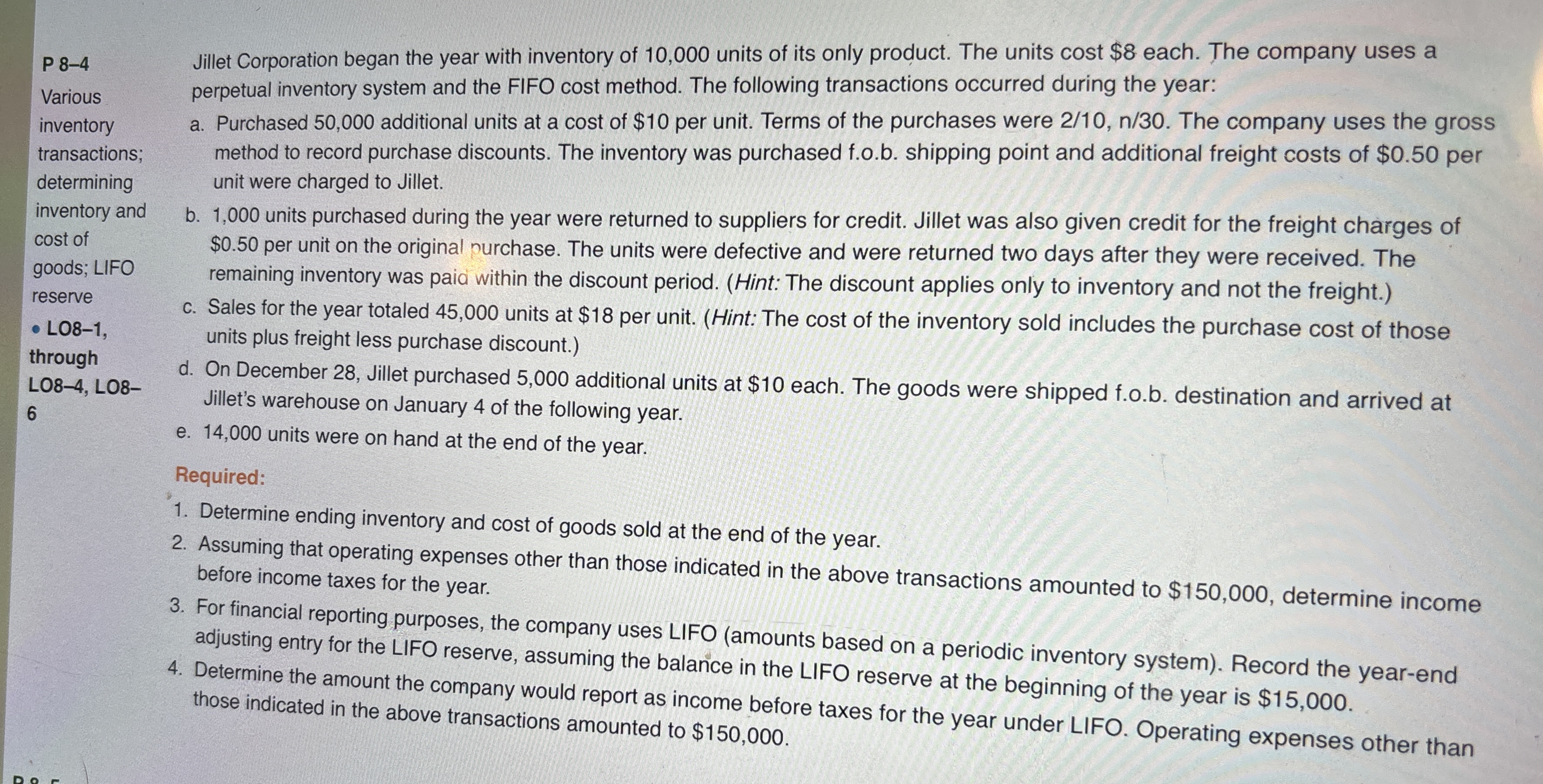

Question: P 8 - 4 Various inventory transactions; determining inventory and cost of goods; LIFO reserve LO 8 - 1 , through LO 8 - 4

P

Various inventory transactions; determining inventory and cost of goods; LIFO reserve

LO through LO LO

Jillet Corporation began the year with inventory of units of its only product. The units cost $ each. The company uses a perpetual inventory system and the FIFO cost method. The following transactions occurred during the year:

a Purchased additional units at a cost of $ per unit. Terms of the purchases were The company uses the gross method to record purchase discounts. The inventory was purchased fob shipping point and additional freight costs of $ per unit were charged to Jillet.

b units purchased during the year were returned to suppliers for credit. Jillet was also given credit for the freight charges of $ per unit on the original purchase. The units were defective and were returned two days after they were received. The remaining inventory was paia within the discount period. Hint: The discount applies only to inventory and not the freight.

c Sales for the year totaled units at $ per unit. Hint: The cost of the inventory sold includes the purchase cost of those units plus freight less purchase discount.

d On December Jillet purchased additional units at $ each. The goods were shipped fob destination and arrived at Jillet's warehouse on January of the following year.

e units were on hand at the end of the year.

Required:

Determine ending inventory and cost of goods sold at the end of the year.

Assuming that operating expenses other than those indicated in the above transactions amounted to $ determine income before income taxes for the year.

For financial reporting purposes, the company uses LIFO amounts based on a periodic inventory system Record the yearend adjusting entry for the LIFO reserve, assuming the balance in the LIFO reserve at the beginning of the year is $

Determine the amount the company would report as income before taxes for the year under LIFO. Operating expenses other than those indicated in the above transactions amounted to $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock