Question: P 8 . 7 A On November 1 , 2 0 2 4 , Sokos Inc. accepted a three - month, 9 % , $

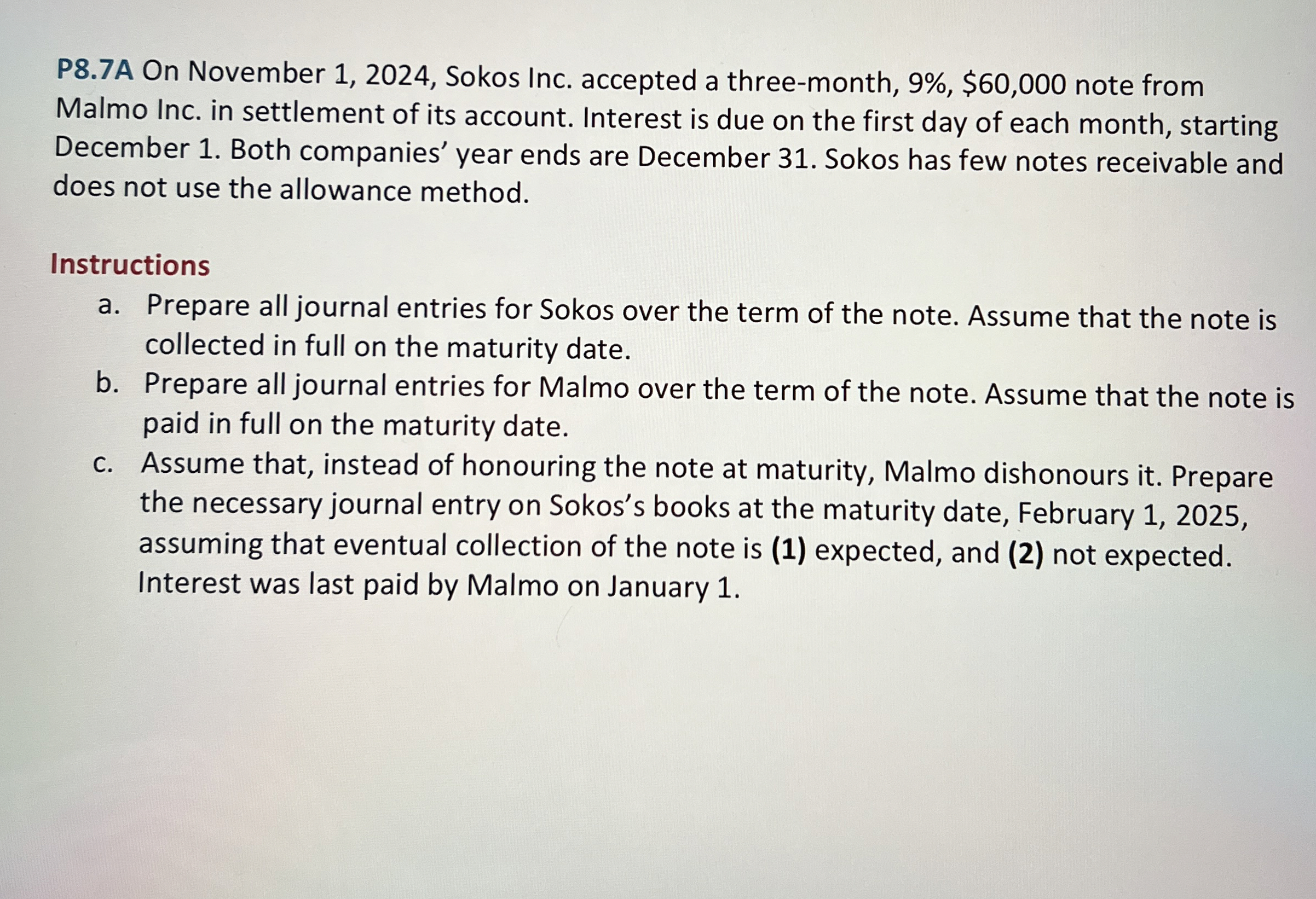

PA On November Sokos Inc. accepted a threemonth, $ note from Malmo Inc. in settlement of its account. Interest is due on the first day of each month, starting December Both companies' year ends are December Sokos has few notes receivable and does not use the allowance method.

Instructions

a Prepare all journal entries for Sokos over the term of the note. Assume that the note is collected in full on the maturity date.

b Prepare all journal entries for Malmo over the term of the note. Assume that the note is paid in full on the maturity date.

c Assume that, instead of honouring the note at maturity, Malmo dishonours it Prepare the necessary journal entry on Sokos's books at the maturity date, February assuming that eventual collection of the note is expected, and not expected. Interest was last paid by Malmo on January

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock