Question: P Ltd and J. Ltd, joint operation versus joint venture, IFRS 11) (Adapted from Singapore CA Qualification Examination, copyright by Singapore Accountancy Commission) P

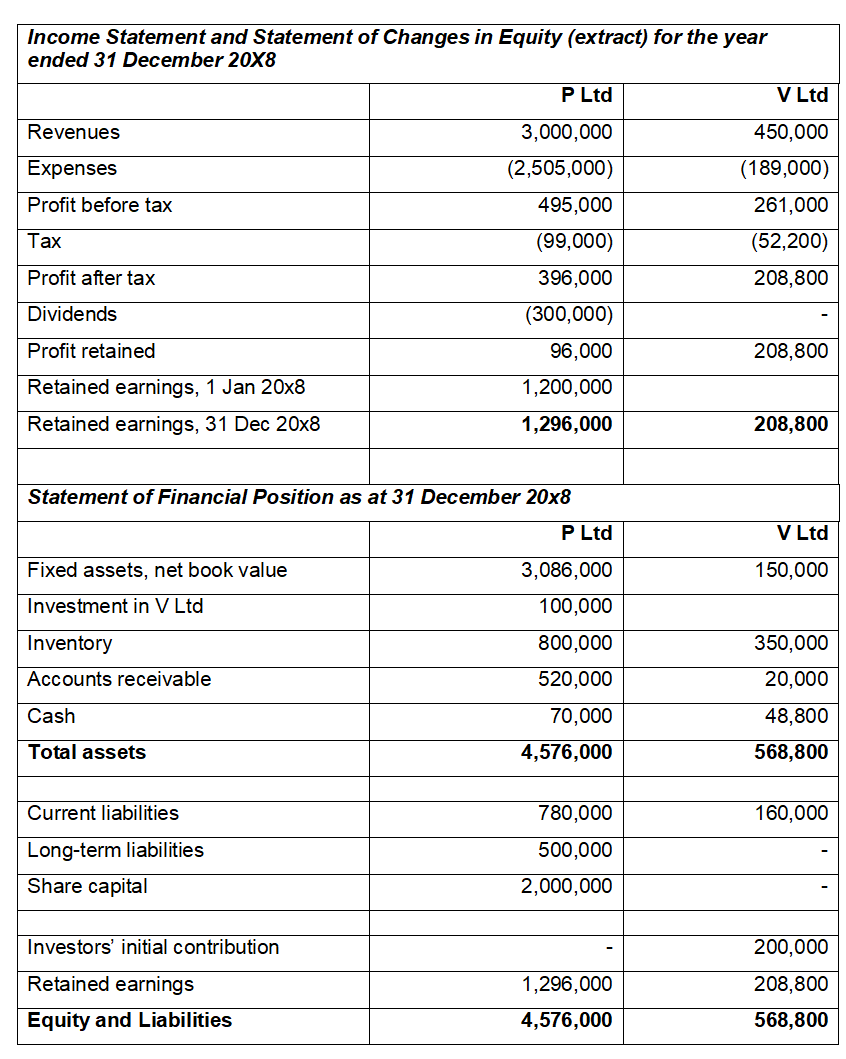

P Ltd and J. Ltd, joint operation versus joint venture, IFRS 11) (Adapted from Singapore CA Qualification Examination, copyright by Singapore Accountancy Commission) P Ltd, a vending machine equipment operator, is keen to enter the business of operating vending machines that sell pre-packaged bubble tea in Singapore. However, P Ltd has no expertise in the preparation of bubble tea. It entered into a joint arrangement with Tong Cha, an expert in this field, to have joint control of V Ltd, the name of the newly incubated joint arrangement. P Ltd has two options: Option 1: Structure the joint arrangement as a 'joint operation'; or Option 2: Structure the joint arrangement as a 'joint venture'. In either option, the agreed allocation between P Ltd and Tong Cha of their interests in the joint operation or joint venture is 50% and the initial outlay by P Ltd is $100,000. The financial statements for the first year of activity of V Ltd are shown below on the next page together with the financial statements of P Ltd for the same period before incorporating the effects of the joint arrangement. Required: Applying the requirements of IFRS 11 Joint Arrangements (equivalent to SFRS(I) 11 Joint Arrangements), determine the following amounts for P Ltd's financial statements for the year ended 31 December 20x8 incorporating the results and financial position of V Ltd under each of the following options: Option 1: V Ltd as a joint operation of P Ltd; and Option 2: V Ltd as a joint venture of P Ltd. (i) Revenue; (ii) Net profit after tax; Income Statement and Statement of Changes in Equity (extract) for the year ended 31 December 20X8 Revenues Expenses Profit before tax Tax Profit after tax Dividends Profit retained Retained earnings, 1 Jan 20x8 Retained earnings, 31 Dec 20x8 P Ltd V Ltd 3,000,000 450,000 (2,505,000) (189,000) 495,000 261,000 (99,000) (52,200) 396,000 208,800 (300,000) 96,000 208,800 1,200,000 1,296,000 208,800 Statement of Financial Position as at 31 December 20x8 Fixed assets, net book value Investment in V Ltd Inventory Accounts receivable Cash Total assets Current liabilities P Ltd V Ltd 3,086,000 150,000 100,000 800,000 350,000 520,000 20,000 70,000 48,800 4,576,000 568,800 780,000 160,000 500,000 2,000,000 Long-term liabilities Share capital Investors' initial contribution 200,000 Retained earnings 1,296,000 208,800 Equity and Liabilities 4,576,000 568,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts