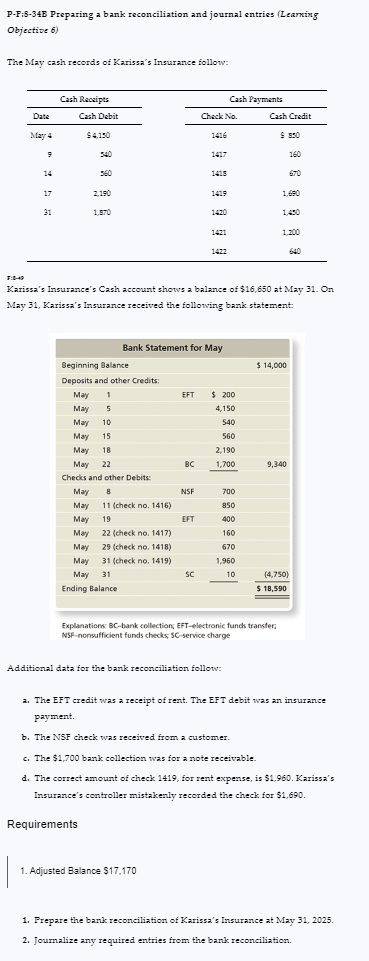

Question: P - P:B - 3 4 B Preparing a bank reconciliation and journal entries ( Learning Objective 6 ) The May cash records of Karissa's

PP:BB Preparing a bank reconciliation and journal entries Learning Objective

The May cash records of Karissa's Insurance follow:

begintabularcccc

hline multicolumnrCash Recsipts & multicolumncCash Payments

hline Date & Cash Debit & Chack No & Cash Credit

hline May & $ & &

hline & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline

endtabular

:

Karissa's Insurance's Cash account shows a balance of $ at May On May Karissa's Insurance received the following bank statement:

begintabularccccc

hline multicolumncBank Statement for May

hline multicolumnlBeginning Balance & $

hline multicolumnlDeposits and other Credits:

hline May & & EFT & $ &

hline May & & & &

hline May & & & &

hline May & & & &

hline May & & & &

hline May & & BC & &

hline multicolumnlChecks and other Debits:

hline May & & NSF & &

hline May & check no & & &

hline May & & EFT & &

hline May & check no & & &

hline May & check no & & &

hline May & check no & & &

hline May & & Sc & &

hline multicolumnlEnding Balance & $

hline

endtabular

Explanations: BCbank collection; EFTelectronic funds transfer; NSFnonsufficient funds checks: SCservice charge

Additional data for the bank reconciliation follow:

a The EFT credit was a receipt of rent. The EFT debit was an insurance payment.

b The NSF check was received from a customer.

c The $ bank collection was for a note receivable.

d The correct amount of check for rent expense, is $ Karissa's Insurance's controller mistakenly recorded the check for $

Requirements

Adjusted Balance $

Prepare the bank reconciliation of Karissa's Insurance at May

Journalize any required entries from the bank reconciliation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock