Question: p please please I sent the question before but the answer not corrected also open the comment box when you answer Problem 6.2A (Algo) Preparation

p

p please please I sent the question before but the answer not corrected also open the comment box when you answer

please please I sent the question before but the answer not corrected also open the comment box when you answer

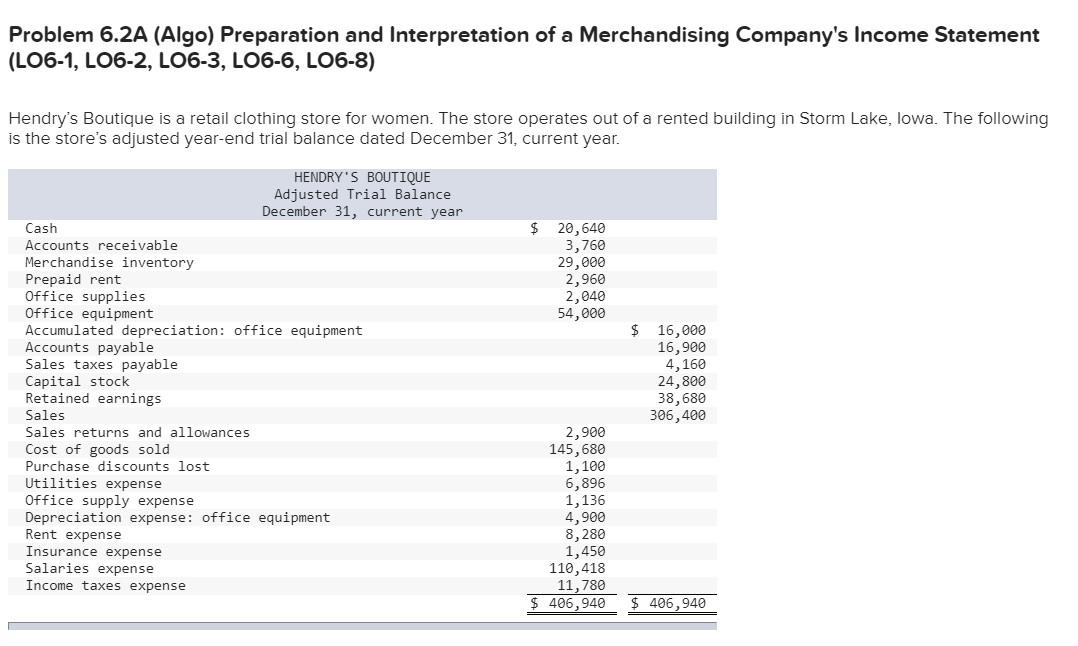

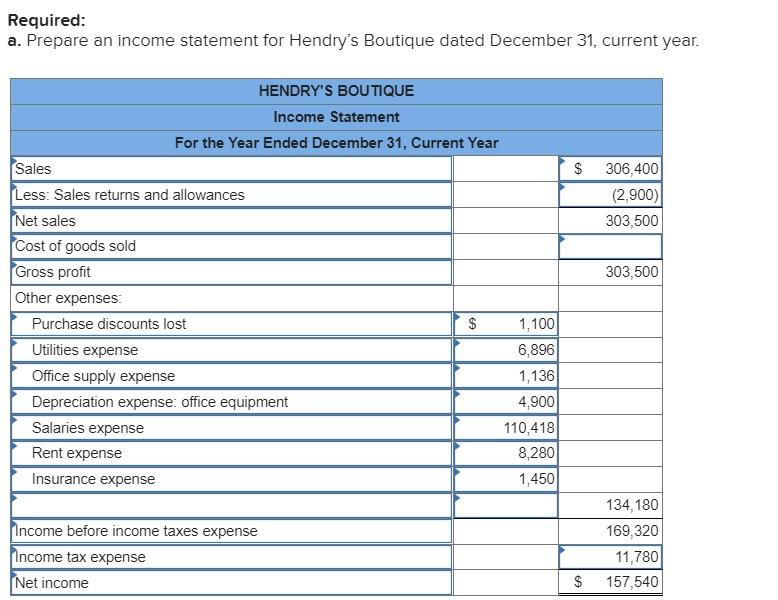

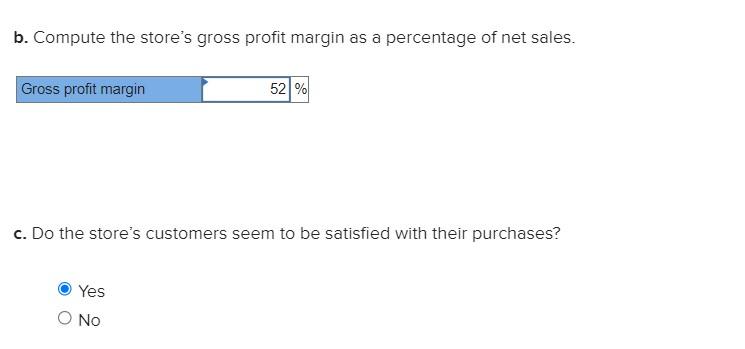

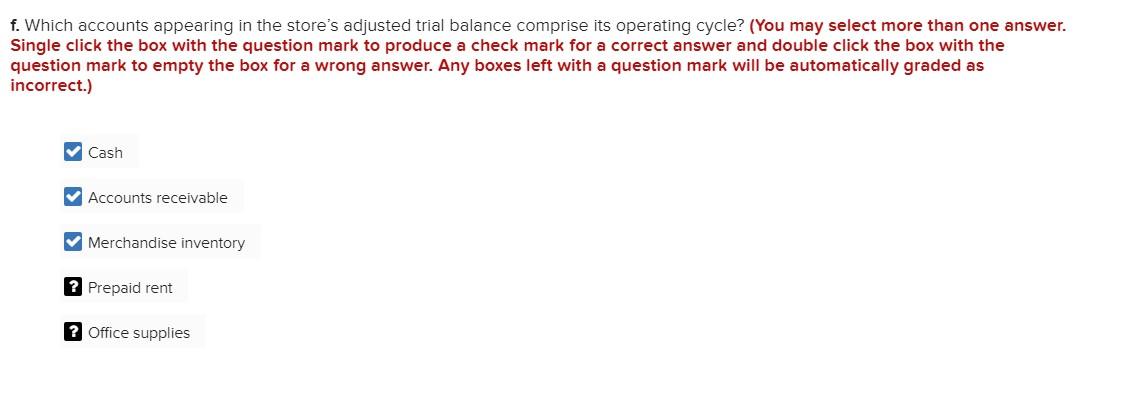

Problem 6.2A (Algo) Preparation and Interpretation of a Merchandising Company's Income Statement (LO6-1, LO6-2, LO6-3, LO6-6, LO6-8) Hendry's Boutique is a retail clothing store for women. The store operates out of a rented building in Storm Lake, Iowa. The following is the store's adjusted year-end trial balance dated December 31, current year. $ 20,640 3,760 29,000 2,960 2,040 54,000 HENDRY'S BOUTIQUE Adjusted Trial Balance December 31, current year Cash Accounts receivable Merchandise inventory Prepaid rent Office supplies Office equipment Accumulated depreciation: office equipment Accounts payable Sales taxes payable Capital stock Retained earnings Sales Sales returns and allowances Cost of goods sold Purchase discounts lost Utilities expense Office supply expense Depreciation expense: office equipment Rent expense Insurance expense Salaries expense Income taxes expense $ 16,000 16,900 4,160 24,800 38,680 306,400 2,900 145, 680 1,100 6,896 1,136 4,900 8,280 1,450 110,418 11,780 $ 406,940 $ 406,940 Required: a. Prepare an income statement for Hendry's Boutique dated December 31, current year. $ 306,400 (2,900) 303,500 303,500 HENDRY'S BOUTIQUE Income Statement For the Year Ended December 31, Current Year Sales Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Other expenses Purchase discounts lost Utilities expense Office supply expense Depreciation expense: office equipment Salaries expense Rent expense Insurance expense $ 1,100 6,896 1,136 4,900 110,418 8,280 1,450 Income before income taxes expense Income tax expense Net income 134,180 169,320 11,780 157,540 $ b. Compute the store's gross profit margin as a percentage of net sales. Gross profit margin 52 % c. Do the store's customers seem to be satisfied with their purchases? Yes O No f. Which accounts appearing in the store's adjusted trial balance comprise its operating cycle? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Cash Accounts receivable Merchandise inventory ? Prepaid rent ? Office supplies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts