Question: P11-24 (similar to) Question Help (Payback period, net present value, profitability Index, and internal rate of return calculations) You are considering a project with an

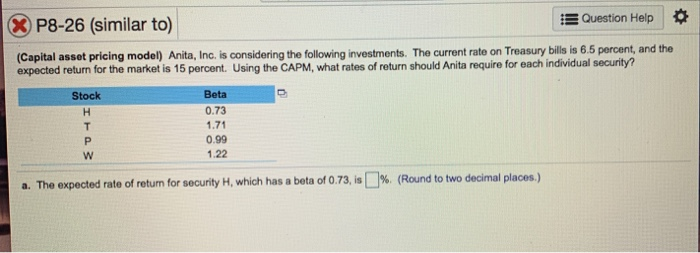

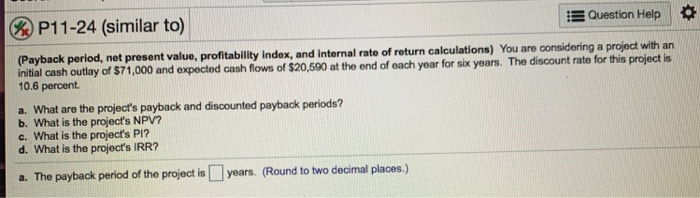

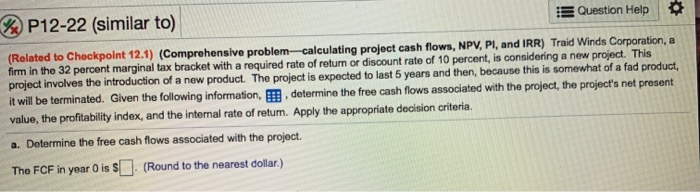

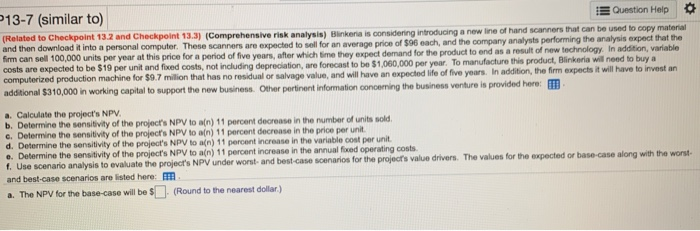

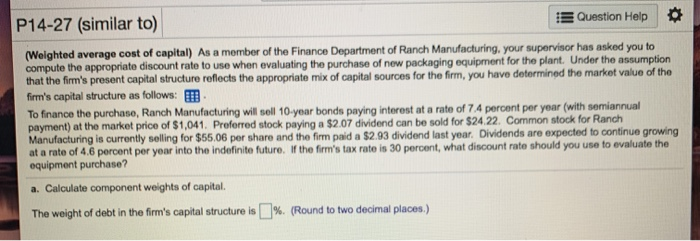

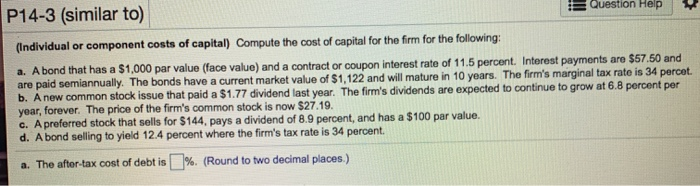

P11-24 (similar to) Question Help (Payback period, net present value, profitability Index, and internal rate of return calculations) You are considering a project with an initial cash outlay of $71,000 and expected cash flows of $20,590 at the end of each year for six years. The discount rate for this project is 10.6 percent. a. What are the project's payback and discounted payback periods? b. What is the project's NPV? c. What is the project's Pl? d. What is the project's IRR? a. The payback period of the project is years. (Round to two decimal places.) WP12-22 (similar to) Question Help (Related to Checkpoint 12.1) (Comprehensive problem calculating project cash flows, NPV, PI, and IRR) Traid Winds Corporation, a firm in the 32 percent marginal tax bracket with a required rate of return or discount rate of 10 percent, is considering a new project. This project involves the introduction of a new product. The project is expected to last 5 years and then, because this is somewhat of a fad product, it will be terminated. Given the following information, . determine the free cash flows associated with the project, the project's net present value, the profitability index, and the internal rate of retum. Apply the appropriate decision criteria a. Determine the free cash flows associated with the project. The FCF in year is S . (Round to the nearest dollar.) 13-7 (similar to) Question Help Related to Checkpoint 13.2 and Checkpoint 13.3) Comprehensive risk analysis) Bankena is considering introducing a new line of hand scanners that can be used to copy material and then download it into a personal computer. These scanners are expected to sell for an average price of $96 each, and the company analysts performing the analysis expect that the firm can sell 100,000 units per year at this price for a period of five years after which ime they expect demand for the product to and as a result of new technology. In addition, variable costs are expected to be $19 per unit and fixed costs, not including depreciation, are forecast to be $1,060,000 per year. To manufacture this product, Blinkeria will need to buy a computerized production machine for $9.7 milion that has no residual or salvage value and will have an expected life of five years. In addition, the firm expects it will have to invest an additional $310,000 in working capital to support the new business. Other pertinent information concerning the business venture is provided here: a. Calculate the project's NPV. b. Determine the sensitivity of the project's NPV to a[n) 11 percent decrease in the number of units sold c. Determine the sensitivity of the project's NPV loan) 11 percent decrease in the price per unit d. Determine the sensitivity of the project's NPV to an) 11 percent increase in the variable cost per unit e. Determine the sensitivity of the project's NPV to ain) 11 percent increase in the annual fixed operating costs f. Use scenario analysis to evaluate the project's NPV under worst and best-case scenarios for the project's value drivers. The values for the expected or base-case along with the worst and best-case scenarios are listed here: a. The NPV for the base-case will be $ (Round to the nearest dollar) P14-27 (similar to) Question Help (Weighted average cost of capital) As a member of the Finance Department of Ranch Manufacturing, your supervisor has asked you to compute the appropriate discount rate to use when evaluating the purchase of new packaging equipment for the plant. Under the assumption that the firm's present capital structure reflects the appropriate mix of capital sources for the firm, you have determined the market value of the firm's capital structure as follows: To finance the purchase, Ranch Manufacturing will sell 10-year bonds paying interest at a rate of 74 percent per year (with semiannual d stock paying a $2.07 dividend can be sold for $24.22. Common stock for Ranch Manufacturing is currently selling for $55.06 per share and the firm paid a $2.93 dividend last year. Dividends are expected to continue growing at a rate of 4.6 percent per year into the indefinite future. If the firm's tax rate is 30 percent, what discount rate should you use to evaluate the equipment purchase? a. Calculate component weights of capital. The weight of debt in the firm's capital structure is %. (Round to two decimal places.) P14-3 (similar to) wuestion Help (Individual or component costs of capital) Compute the cost of capital for the firm for the following: a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 11.5 percent. Interest payments are $57.50 and are paid semiannually. The bonds have a current market value of $1,122 and will mature in 10 years. The firm's marginal tax rate is 34 percet. b. A new common stock issue that paid a $1.77 dividend last year. The firm's dividends are expected to continue to grow at 6.8 percent per year, forever. The price of the firm's common stock is now $27.19. C. A preferred stock that sells for $144, pays a dividend of 8.9 percent, and has a $100 par value. d. A bond selling to yield 12.4 percent where the firm's tax rate is 34 percent a. The after-tax cost of debt is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts