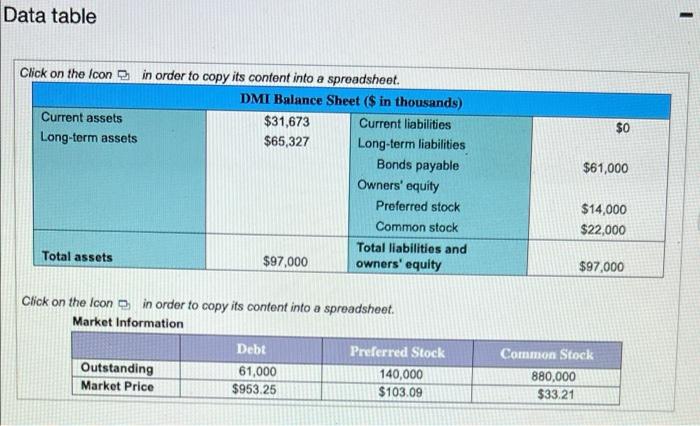

Question: p11.Q.9 Data table 1 $0 Click on the icon in order to copy its content into a spreadsheet. DMI Balance Sheet ($ in thousands) Current

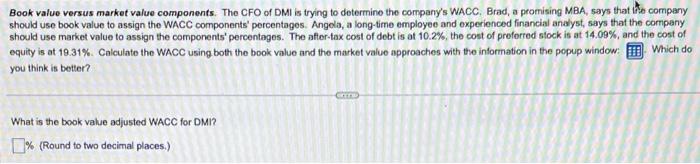

Data table 1 $0 Click on the icon in order to copy its content into a spreadsheet. DMI Balance Sheet ($ in thousands) Current assets $31,673 Current liabilities Long-term assets $65,327 Long-term liabilities Bonds payable Owners' equity Preferred stock Common stock Total liabilities and Total assets $97,000 owners' equity $61,000 $14,000 $22,000 $97,000 Click on the Icon in order to copy its content into a spreadsheet. Market Information Debt Preferred Stock Outstanding 61,000 140,000 Market Price $953.25 $103.09 Common Stock 880,000 $33.21 Book value versus market value components. The CFO of DM is trying to determine the company's WACC. Brad, a promising MBA, says that to company should use book value to assign the WACC components' percentages. Angelo, a long-time employee and experienced financial analyst , says that the company should use market value to assign the components' percentages. The after tax cost of debt is at 10.2%, the cost of proferred stock is at 14.09%, and the cost of equity is at 19.31% Calculate the WACC using both the book value and the market value approaches with the information in the popup window you think is better? Which do What is the book value adjusted WACC for DMI? 1% (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts