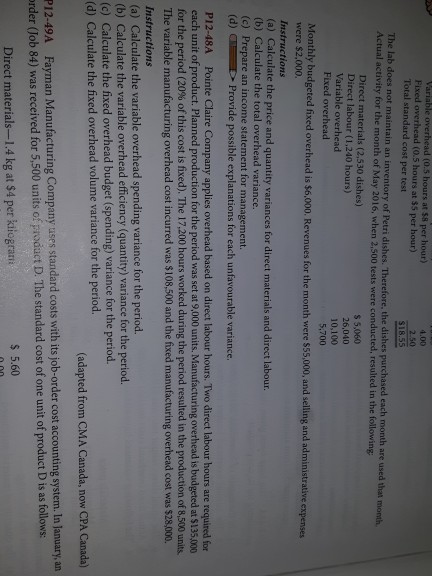

Question: p12-48A Variable overhead (0.5 hours at $8 per hour) Fixed overhead (0.5 hours at $5 per hour) Total standard cost per test 4.00 2.50 S18.55

p12-48A

Variable overhead (0.5 hours at $8 per hour) Fixed overhead (0.5 hours at $5 per hour) Total standard cost per test 4.00 2.50 S18.55 The lab does not maintain an inventory of Petri dishes. Therefore, the dishes purc Actual activity for the month of May 2016, when 2.500 test ts were conducted, resulted in the following Direct materials (2,530 dishes) Direct labour (1,240 hours) Variable overhead Fixed overhead $ 5,060 26,040 10,100 5,700 Monthly budgeted fixed overhead is $6,000. Revenues for the month were $55,000,and selling and administrative expenses were $2.000 (a) Calculate the price and quantity variances for direct materials and direct labour (b) Calculate the total overhead variance. (c) Prepare an income statement for management (d) Provide possible explanations for each unfavourable variance P12-48A Pointe Claire Company applies overhead based on direct labour hours. Two direct labour hours are required for each unit of product. Planned production for the period was set at 9,000 units. Manufacturing overhead is budgeted at $135,000 for the period (20% of this cost is fixed). The l 7,200 hours worked during the period resulted in the production of 8,500 units The variable manufacturing overhead cost incurred was $108,500 and the fixed manufacturing overhead cost was $28,000. Instructions (a) Calculate the variable overhead spending variance for the period. (b) Calculate the variable overhead efficiency (quantity) variance for the period. (c) Calculate the fixed overhead budget (spending) variance for the period. (d) Calculate the fixed overhead volume variance for the period. (adapted from CMA Canada, now CPA Canada) P12-49A Fayman rder (Job 84) was received for 5,500 units of p Manufacturing Company uses standard costs with its job-order cost accounting system. In January, an roduct D. The standard cost of one unit of product D is as follows: s 5.60 Direct materials-1.4 kg at $4 per kliograri Variable overhead (0.5 hours at $8 per hour) Fixed overhead (0.5 hours at $5 per hour) Total standard cost per test 4.00 2.50 S18.55 The lab does not maintain an inventory of Petri dishes. Therefore, the dishes purc Actual activity for the month of May 2016, when 2.500 test ts were conducted, resulted in the following Direct materials (2,530 dishes) Direct labour (1,240 hours) Variable overhead Fixed overhead $ 5,060 26,040 10,100 5,700 Monthly budgeted fixed overhead is $6,000. Revenues for the month were $55,000,and selling and administrative expenses were $2.000 (a) Calculate the price and quantity variances for direct materials and direct labour (b) Calculate the total overhead variance. (c) Prepare an income statement for management (d) Provide possible explanations for each unfavourable variance P12-48A Pointe Claire Company applies overhead based on direct labour hours. Two direct labour hours are required for each unit of product. Planned production for the period was set at 9,000 units. Manufacturing overhead is budgeted at $135,000 for the period (20% of this cost is fixed). The l 7,200 hours worked during the period resulted in the production of 8,500 units The variable manufacturing overhead cost incurred was $108,500 and the fixed manufacturing overhead cost was $28,000. Instructions (a) Calculate the variable overhead spending variance for the period. (b) Calculate the variable overhead efficiency (quantity) variance for the period. (c) Calculate the fixed overhead budget (spending) variance for the period. (d) Calculate the fixed overhead volume variance for the period. (adapted from CMA Canada, now CPA Canada) P12-49A Fayman rder (Job 84) was received for 5,500 units of p Manufacturing Company uses standard costs with its job-order cost accounting system. In January, an roduct D. The standard cost of one unit of product D is as follows: s 5.60 Direct materials-1.4 kg at $4 per kliograri

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts