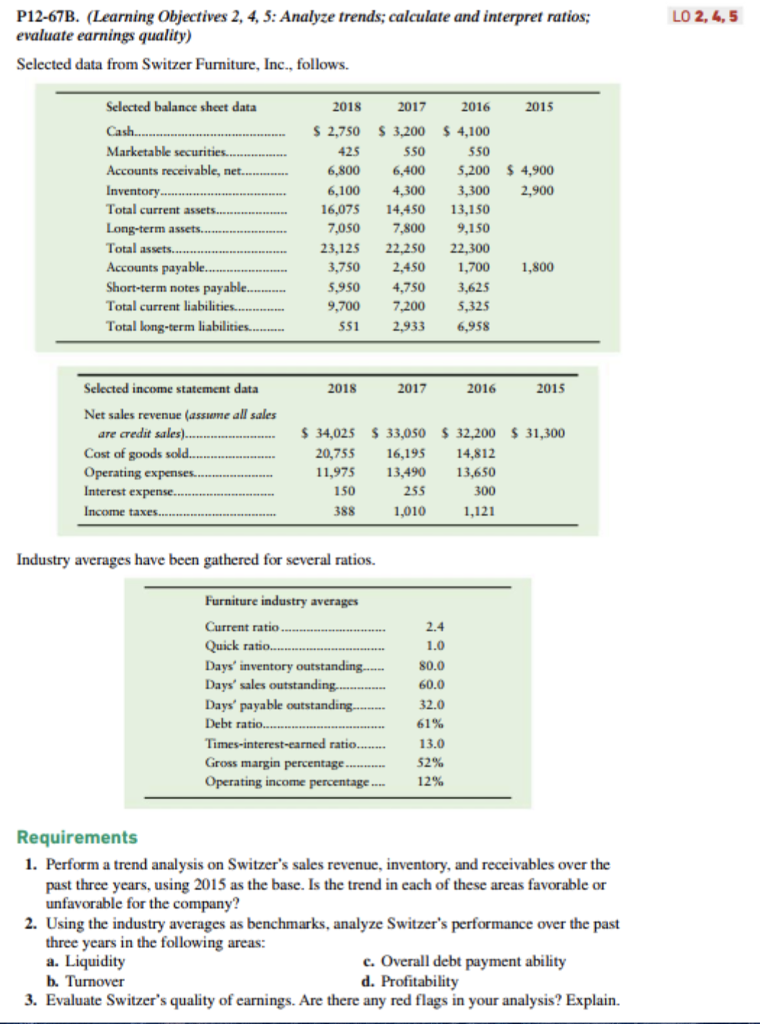

Question: P12-67B. (Learning Objectives 2, 4, 5: Analyze trends; calculate and interpret ratios evaluate earnings quality) Selected data from Switzer Furniture, Inc., follows. LO 2,4, 5

P12-67B. (Learning Objectives 2, 4, 5: Analyze trends; calculate and interpret ratios evaluate earnings quality) Selected data from Switzer Furniture, Inc., follows. LO 2,4, 5 Selected balance sheet data 2018 2017 2016 2015 S 2,750 3,200 4,100 550 Marketable securities Accounts receivable, Inventory Total current 425 6,8006,400 5,200 4,900 6,100 4,300 3,300 2,900 550 16,075 14,450 13,150 7,0507,8009,150 Total as Accounts payable Short-term notes payable. Total current li Total long-term 23,125 22,250 22,300 3,7502,450 ,700 1,80 ,9504,750 3,625 9,7007,200 5,325 551 2,9336,958 Selected income statement data 2018 2017 2016 2015 Net sales revenue (asswne all sales 34,025 $ 33,050 $32,200 31,300 are credit sales) Cost of goods sold...20,755 16,195 14,812 1,975 13,490 13,650 150 388 Interest ex 255 300 1,010 1,121 Industry averages have been gathered for several ratios. Furniture industry averages Current ratio Quick ra Days' inventory outstanding..80.0 Days' sales outstanding 60.0 Days' payable outstanding...32.0 2.4 1.0 61% 52% Gross margin percentage Operating income percentage 12% Requirements 1. Perform a trend analysis on Switzer's sales revenue, inventory, and receivables over the past three years, using 2015 as the base. Is the trend in each of these areas favorable or unfavorable for the company? 2. Using the industry averages as benchmarks, analyze Switzer's performance over the past in the following areas: three years a. Liquidity b. Turnover e. Overall debt payment ability d. Profitability 3. Evaluate Switzer's quality of earnings. Are there any red flags in your analysis? Explain. P12-67B. (Learning Objectives 2, 4, 5: Analyze trends; calculate and interpret ratios evaluate earnings quality) Selected data from Switzer Furniture, Inc., follows. LO 2,4, 5 Selected balance sheet data 2018 2017 2016 2015 S 2,750 3,200 4,100 550 Marketable securities Accounts receivable, Inventory Total current 425 6,8006,400 5,200 4,900 6,100 4,300 3,300 2,900 550 16,075 14,450 13,150 7,0507,8009,150 Total as Accounts payable Short-term notes payable. Total current li Total long-term 23,125 22,250 22,300 3,7502,450 ,700 1,80 ,9504,750 3,625 9,7007,200 5,325 551 2,9336,958 Selected income statement data 2018 2017 2016 2015 Net sales revenue (asswne all sales 34,025 $ 33,050 $32,200 31,300 are credit sales) Cost of goods sold...20,755 16,195 14,812 1,975 13,490 13,650 150 388 Interest ex 255 300 1,010 1,121 Industry averages have been gathered for several ratios. Furniture industry averages Current ratio Quick ra Days' inventory outstanding..80.0 Days' sales outstanding 60.0 Days' payable outstanding...32.0 2.4 1.0 61% 52% Gross margin percentage Operating income percentage 12% Requirements 1. Perform a trend analysis on Switzer's sales revenue, inventory, and receivables over the past three years, using 2015 as the base. Is the trend in each of these areas favorable or unfavorable for the company? 2. Using the industry averages as benchmarks, analyze Switzer's performance over the past in the following areas: three years a. Liquidity b. Turnover e. Overall debt payment ability d. Profitability 3. Evaluate Switzer's quality of earnings. Are there any red flags in your analysis? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts