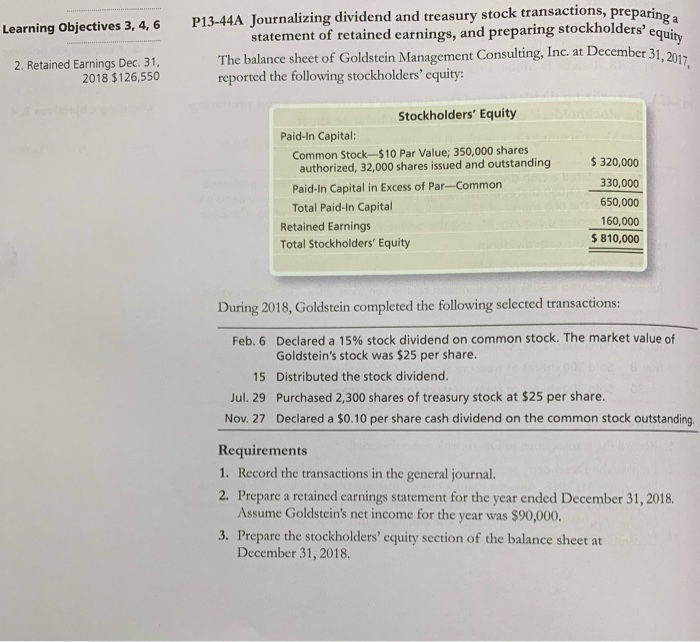

Question: P13-44A Journalizing dividend and treasury stock transactions, preparing a statement of retained earnings, and preparing stockholders' equity The balance sheet of Goldstein Management Consulting, Inc.

P13-44A Journalizing dividend and treasury stock transactions, preparing a statement of retained earnings, and preparing stockholders' equity The balance sheet of Goldstein Management Consulting, Inc. at December 31, 2017, reported the following stockholders' equity: Learning Objectives 3, 4, 6 2. Retained Earnings Dec. 31, 2018 $126,550 Stockholders' Equity Paid-In Capital: Common Stock-$10 Par Value; 350,000 shares authorized, 32,000 shares issued and outstanding $ 320,000 330,000 Paid-In Capital in Excess of Par-Common 650,000 Total Paid-In Capital 160,000 Retained Earnings $ 810,000 Total Stockholders' Equity During 2018, Goldstein completed the following selected transactions: Feb. 6 Declared a 15% stock dividend on common stock. The market value of Goldstein's stock was $25 per share. Distributed the stock dividend. 15 Jul. 29 Purchased 2,300 shares of treasury stock at $25 per share. Nov. 27 Declared a $0.10 per share cash dividend on the common stock outstanding. Requirements 1. Record the transactions in the general journal. 2. Prepare a retained earnings statement for the year ended December 31, 2018. Assume Goldstein's net income for the year was $90,000. 3. Prepare the stockholders' equity section of the balance sheet at December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts