Question: P13.6A (LO 3. 4. 5) AP Memphis Ltd. is a private corporation reporting under ASPE. It has recorded all necessary adjusting entries at its

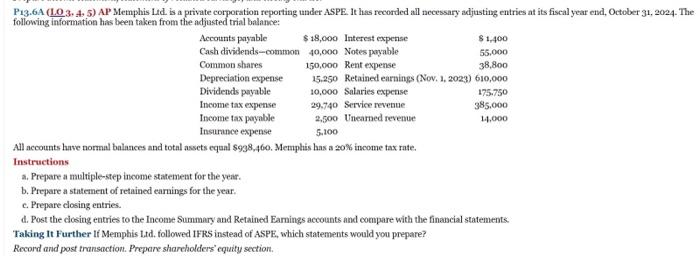

P13.6A (LO 3. 4. 5) AP Memphis Ltd. is a private corporation reporting under ASPE. It has recorded all necessary adjusting entries at its fiscal year end, October 31, 2024. The following information has been taken from the adjusted trial balance: Accounts payable $18,000 Interest expense Cash dividends-common 40,000 Notes payable Common shares Depreciation expense Dividends payable Income tax expense Income tax payable $1,400 55.000 150,000 Rent expense 38,800 15.250 Retained earnings (Nov. 1, 2023) 610,000 10,000 Salaries expense 175.750 29.740 Service revenue 385.000 14,000 Insurance expense 2,500 Unearned revenue 5.100 All accounts have normal balances and total assets equal $938,460. Memphis has a 20% income tax rate. Instructions a. Prepare a multiple-step income statement for the year. b. Prepare a statement of retained earnings for the year. c. Prepare closing entries. d. Post the closing entries to the Income Summary and Retained Earnings accounts and compare with the financial statements. Taking It Further If Memphis Ltd. followed IFRS instead of ASPE, which statements would you prepare? Record and post transaction. Prepare shareholders' equity section.

Step by Step Solution

There are 3 Steps involved in it

I have opened the image which contains a financial ... View full answer

Get step-by-step solutions from verified subject matter experts