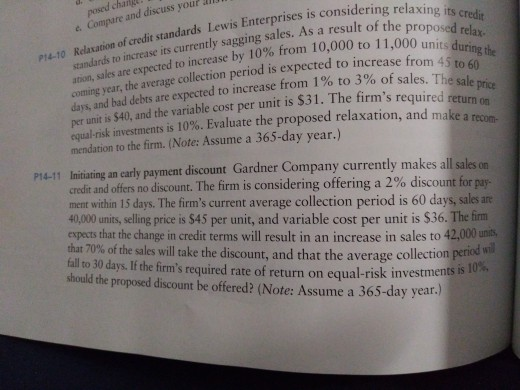

Question: P14-11 considering relaxing its e Compare and discuss your credit its currently sagging sales. As a result of the pro P14-10 Relaxation of credit standards

P14-11

considering relaxing its e Compare and discuss your credit its currently sagging sales. As a result of the pro P14-10 Relaxation of credit standards Lewis Enterprises is con standards to increase its c ation, sales are expected to incr coming year, the average collection period is expected to increase from 4 days, and bad debts are expected to increase from, 1 %to 3% of sales. The per unit is $40, and the variable cost per unit is $31. The firm's ease by 10% from 10,000 to 11,000 unit d 5 to 60 price required return on I-risk investments is 10%. Evaluate the proposed relaxation, and make a equa mendation to the firm. (Note: Assume a 365-day year.) Initiating an carly payment discount Gardner Company currently makes all sales on credit and offers no discount. The firin is considering offering a 2% discount for pay. ment within 15 days. The firm's current average collection period is 60 days, sales are P14-11 40,0 units,selig price is S45 per unit, and variable cost per unit is $36. The fim expects that the change in credit terms will result in an increase in sales to 42,000 unts that 70% of the sales will take the discount, and that the average collection per fall o 30 days.If the firm's required rate of return on eq should the proposed discount be offered? (Note: Assume a 365-day year. od wi s required rate of return on equal-risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts