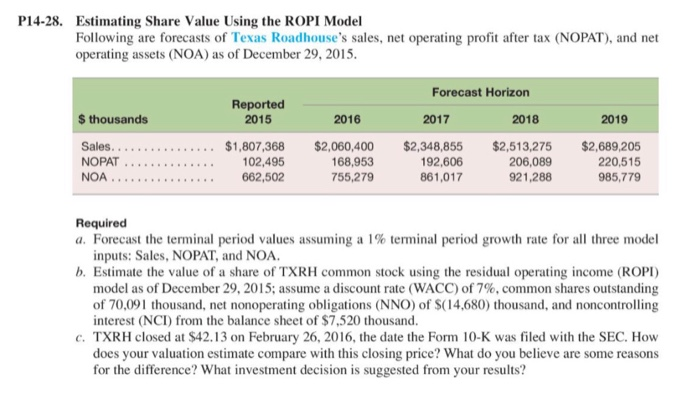

Question: P14-28. Estimating Share Value Using the ROPI Model Following are forecasts of Texas Roadhouse's sales, net operating profit after tax (NOPAT), and net operating assets

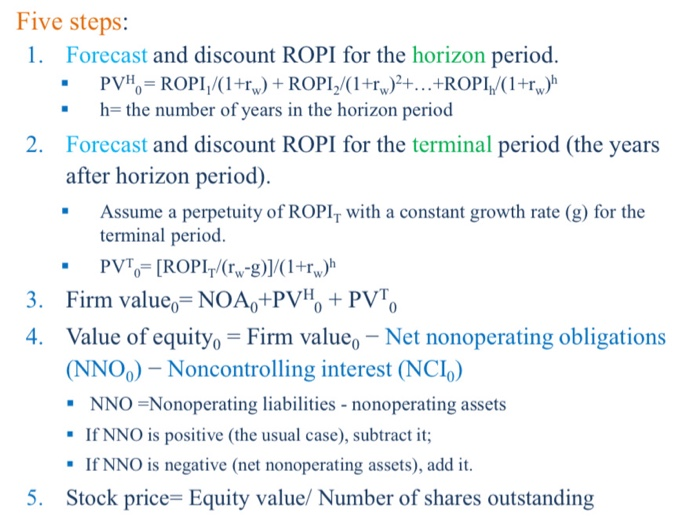

P14-28. Estimating Share Value Using the ROPI Model Following are forecasts of Texas Roadhouse's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of December 29, 2015. Forecast Horizon Reported 2015 $ thousands 2016 2017 2018 2019 ............. NOPAT ...... ........... $1,807,368 102,495 662,502 $2,060,400 168,953 755,279 $2,348,855 192,606 861,017 $2,513,275 206,089 921,288 $2,689,205 220,515 985,779 NOA.... Required a. Forecast the terminal period values assuming a 1% terminal period growth rate for all three model inputs: Sales, NOPAT, and NOA. b. Estimate the value of a share of TXRH common stock using the residual operating income (ROPI) model as of December 29, 2015; assume a discount rate (WACC) of 7%, common shares outstanding of 70,091 thousand, net nonoperating obligations (NNO) of $(14.680) thousand, and noncontrolling interest (NCI) from the balance sheet of $7,520 thousand. c. TXRH closed at $42.13 on February 26, 2016, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results? Five steps: 1. Forecast and discount ROPI for the horizon period. PVH = ROPI/(1+rw) + ROPI/(1+rw)2+...+ROPI/(1+rw)h . h= the number of years in the horizon period 2. Forecast and discount ROPI for the terminal period (the years after horizon period). Assume a perpetuity of ROPI, with a constant growth rate (g) for the terminal period. PVT,= [ROPI/(rw-g)]/(1+rwh 3. Firm value = NOA,+PVH. + PVT, 4. Value of equity, = Firm value, - Net nonoperating obligations (NNO) -Noncontrolling interest (NCI) . NNO =Nonoperating liabilities - nonoperating assets . If NNO is positive (the usual case), subtract it; If NNO is negative (net nonoperating assets), add it. 5. Stock price= Equity value/ Number of shares outstanding ROPI model Firm Value = NOA + Present Value of Future [NOPAT - (NOA Bee X r)] ROPI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts