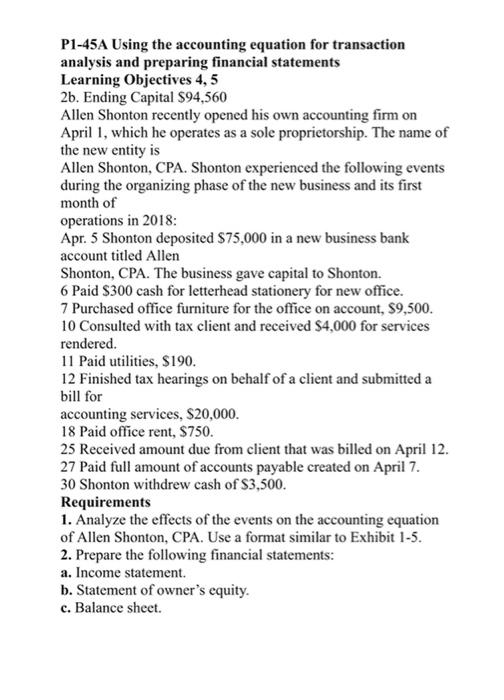

Question: P1-45A Using the accounting equation for transaction analysis and preparing financial statements Learning Objectives 4,5 2b. Ending Capital $94,560 Allen Shonton recently opened his own

P1-45A Using the accounting equation for transaction analysis and preparing financial statements Learning Objectives 4,5 2b. Ending Capital $94,560 Allen Shonton recently opened his own accounting firm on April 1, which he operates as a sole proprietorship. The name of the new entity is Allen Shonton, CPA. Shonton experienced the following events during the organizing phase of the new business and its first month of operations in 2018: Apr. 5 Shonton deposited S75,000 in a new business bank account titled Allen Shonton, CPA. The business gave capital to Shonton. 6 Paid $300 cash for letterhead stationery for new office. 7 Purchased office furniture for the office on account, $9,500. 10 Consulted with tax client and received $4,000 for services rendered. 11 Paid utilities, $190. 12 Finished tax hearings on behalf of a client and submitted a bill for accounting services, $20,000. 18 Paid office rent, $750. 25 Received amount due from client that was billed on April 12. 27 Paid full amount of accounts payable created on April 7. 30 Shonton withdrew cash of $3,500. Requirements 1. Analyze the effects of the events on the accounting equation of Allen Shonton, CPA. Use a format similar to Exhibit 1-5. 2. Prepare the following financial statements: a. Income statement b. Statement of owner's equity. c. Balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts