Question: P15-41. Reverse Engineering with the PB Ratio The following table provides summary data for Darden Restaurants Inc. (in millions). Analysts will often use the

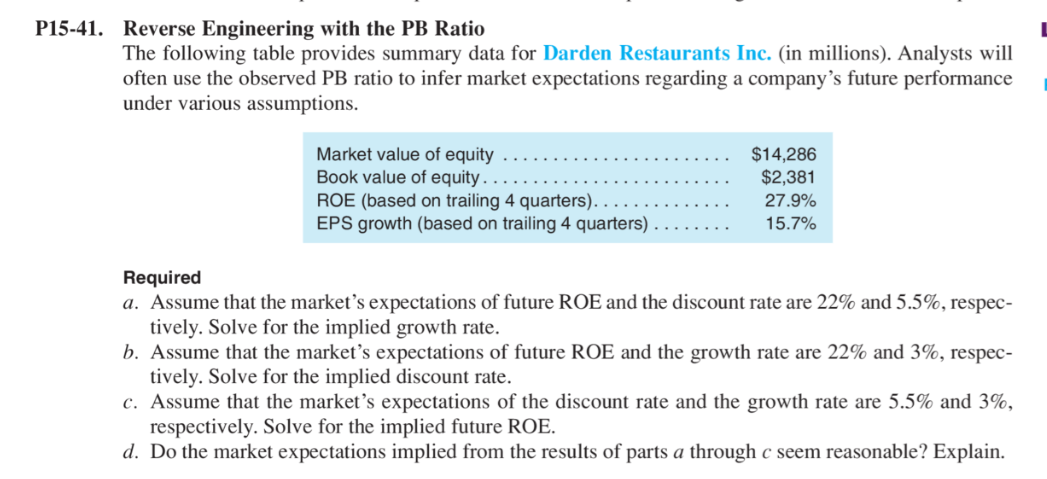

P15-41. Reverse Engineering with the PB Ratio The following table provides summary data for Darden Restaurants Inc. (in millions). Analysts will often use the observed PB ratio to infer market expectations regarding a company's future performance under various assumptions. Market value of equity Book value of equity... ROE (based on trailing 4 quarters).. EPS growth (based on trailing 4 quarters). $14,286 $2,381 27.9% 15.7% Required a. Assume that the market's expectations of future ROE and the discount rate are 22% and 5.5%, respec- tively. Solve for the implied growth rate. b. Assume that the market's expectations of future ROE and the growth rate are 22% and 3%, respec- tively. Solve for the implied discount rate. c. Assume that the market's expectations of the discount rate and the growth rate are 5.5% and 3%, respectively. Solve for the implied future ROE. d. Do the market expectations implied from the results of parts a through c seem reasonable? Explain.

Step by Step Solution

There are 3 Steps involved in it

To solve these parts we will use the PricetoBook PB ratio formula along with dividend discount models to determine the implied growth rate discount ra... View full answer

Get step-by-step solutions from verified subject matter experts