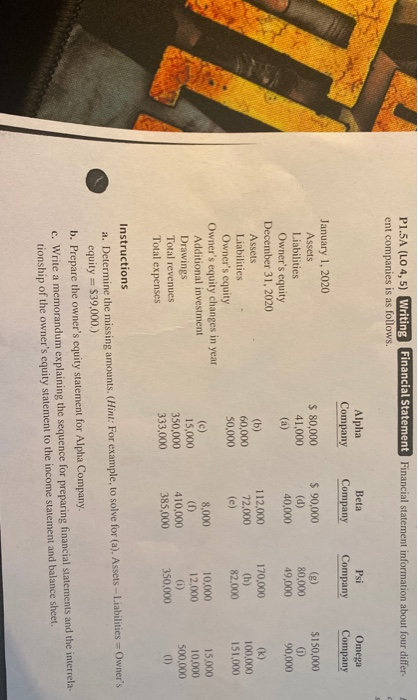

Question: P1.5A (LO 4,5) Writing Financial Statement Financial statement information about four differ ent companies is as follows. Psi Omega Alpha Company Beta Company Company Company

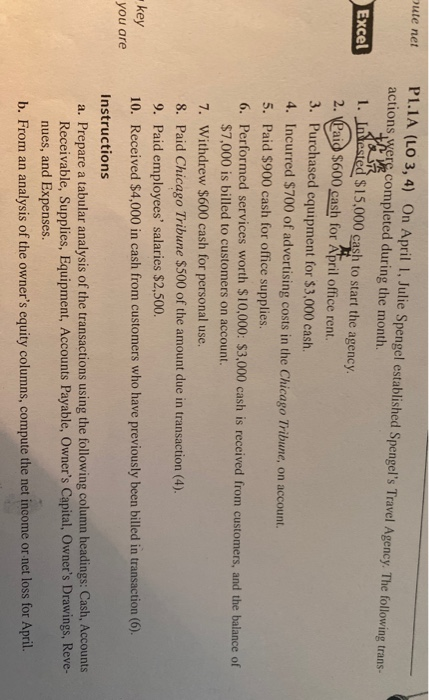

P1.5A (LO 4,5) Writing Financial Statement Financial statement information about four differ ent companies is as follows. Psi Omega Alpha Company Beta Company Company Company $ 80,000 41,000 (a) $ 90,000 (d) 40,000 (g) 80,000 49.000 $150,000 () 90,000 January 1, 2020 Assets Liabilities Owner's equity December 31, 2020 Assets Liabilities Owner's equity Owner's equity changes in year Additional investment Drawings Total revenues Total expenses (b) 60,000 50,000 112,000 72,000 (e) 170,000 (h) 82.000 (k) 100,000 151,000 (c) 15,000 350,000 333,000 8,000 (1) 410,000 385.000 10.000 12,000 (i) 350,000 15,000 10.000 500,000 (1) Instructions a. Determine the missing amounts. (Hint: For example, to solve for (a). Assets - Liabilities Owner's equity = $39.000.) b. Prepare the owner's equity statement for Alpha Company. c. Write a memorandum explaining the sequence for preparing financial statements and the interrela tionship of the owner's equity statement to the income statement and balance sheel. pute net Excel P1.1A (LO 3,4) On April 1, Julie Spengel established Spengel's Travel Agency. The following trans- actions were completed during the month. 1. In tested $15,000 cash to start the agency. 2. Paid $600 cash for April office rent. 3. Purchased equipment for $3,000 cash. 4. Incurred $700 of advertising costs in the Chicago Tribune, on account. 5. Paid $900 cash for office supplies. 6. Performed services worth $10,000: $3,000 cash is received from customers, and the balance of $7,000 is billed to customers on account. 7. Withdrew $600 cash for personal use. 8. Paid Chicago Tribune $500 of the amount due in transaction (4). 9. Paid employees' salaries $2,500. 10. Received $4,000 in cash from customers who have previously been billed in transaction (6). Instructions a. Prepare a tabular analysis of the transactions using the following column headings: Cash, Accounts Receivable, Supplies, Equipment, Accounts Payable, Owner's Capital, Owner's Drawings, Reve. nues, and Expenses. b. From an analysis of the owner's equity columns, compute the net income or net loss for April. key you are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts