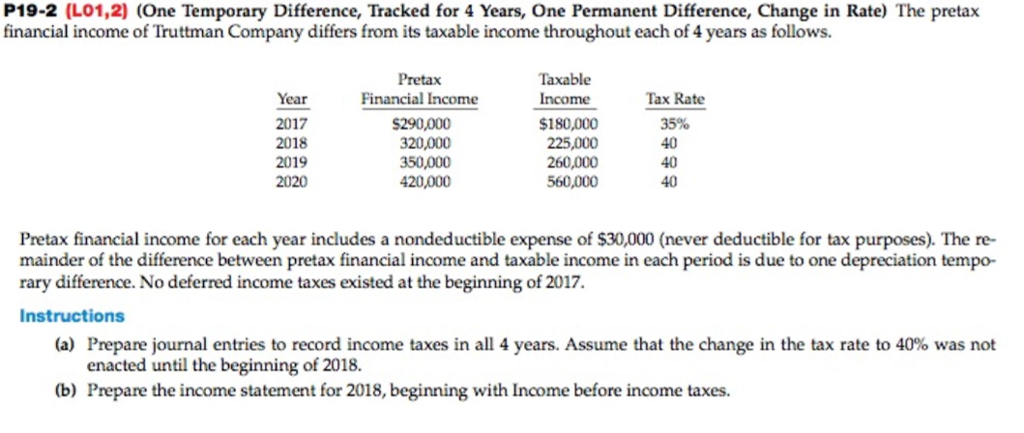

Question: P19-2 (L01,2) (One Temporary Difference, Tracked for 4 Years, One Permanent Difference, Change in Rate) The pretax financial income of Truttman Company differs from its

P19-2 (L01,2) (One Temporary Difference, Tracked for 4 Years, One Permanent Difference, Change in Rate) The pretax financial income of Truttman Company differs from its taxable income throughout each of 4 years as follows. Pretax Financial Income $290,000 320,000 350,000 420,000 Taxable Income ear 2017 2018 2019 2020 $180,000 225,000 260,000 560,000 Tax Rate 35% 40 40 40 Pretax financial income for each year includes a nondeductible expense of $30,000 (never deductible for tax purposes). The re- mainder of the difference between pretax financial income and taxable income in each period is due to one depreciation tempo- rary difference. No deferred income taxes existed at the beginning of 2017. Instructions (a) Prepare journal entries to record income taxes in all 4 years. Assume that the change in the tax rate to 40% was not enacted until the beginning of 2018. (b) Prepare the income statement for 2018, beginning with Income before income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts