Question: p.2 3. (18) A store is under consideration with a ten-year life and with expenses of $100,000 per year and will likely produce revenue of

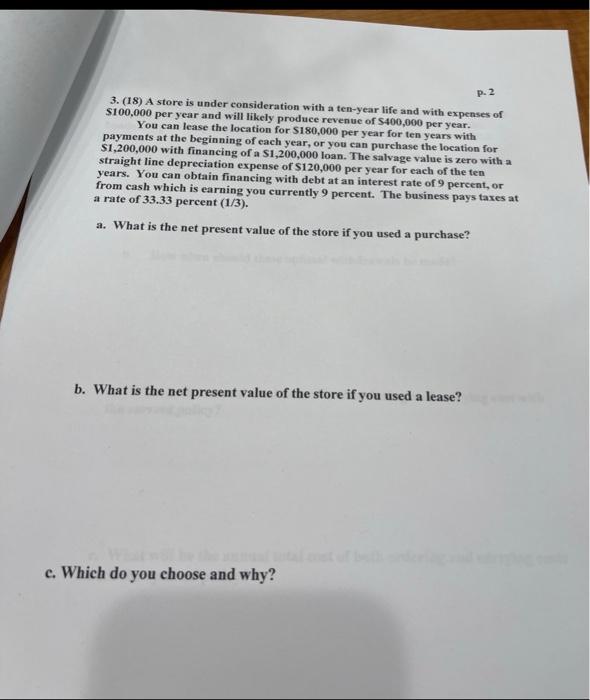

p.2 3. (18) A store is under consideration with a ten-year life and with expenses of $100,000 per year and will likely produce revenue of $400,000 per year. You can lease the location for S180,000 per year for ten years with payments at the beginning of each year, or you can purchase the location for $1,200,000 with financing of a S1,200,000 loan. The salvage value is zero with a straight line depreciation expense of $120,000 per year for each of the ten years. You can obtain financing with debt at an interest rate of 9 percent, or from cash which is earning you currently 9 percent. The business pays taxes at 9 a rate of 33.33 percent (1/3). a. What is the net present value of store if you used a purchase? b. What is the net present value of the store if you used a lease? c. Which do you choose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts