Question: P2021 AC 10-AN FX Question 5.Ch 12 Homework + education.com/mapindex.html?_con-con external_browserBlaunchur 253A5%252P%252Fims meducation.com 252mghmiedewares25 work Hero Save & E Required information [The following information applies

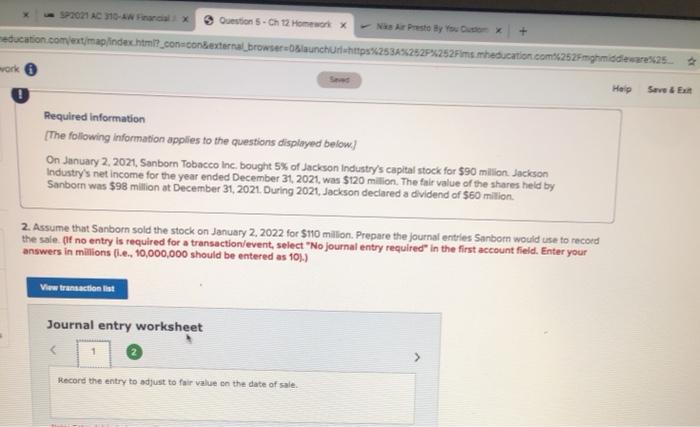

P2021 AC 10-AN FX Question 5.Ch 12 Homework + education.com/mapindex.html?_con-con external_browserBlaunchur 253A5%252P%252Fims meducation.com 252mghmiedewares25 work Hero Save & E Required information [The following information applies to the questions displayed below.) On January 2, 2021, Sanborn Tobacco Inc. bought 5% of Jackson Industry's capital stock for $90 million Jackson Industry's net income for the year ended December 31, 2021, was $120 milion. The fair value of the shares held by Sanborn was $98 million at December 31, 2021. During 2021. Jackson declared a dividend of $60 milion 2. Assume that Sanborn sold the stock on January 2, 2022 for $110 million. Prepare the journal entries Sanborn would use to record the sale of no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions (ie, 10,000,000 should be entered as 101.) View transaction fist Journal entry worksheet Record the entry to adjust to fair value on the date of sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts