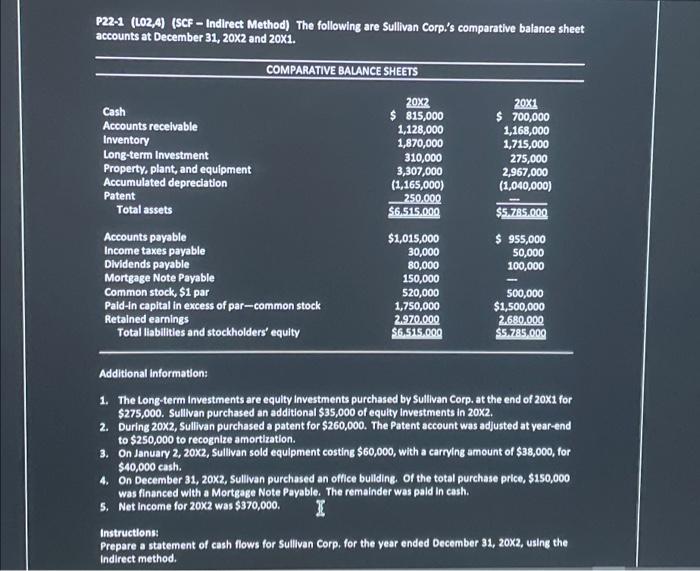

Question: P22-1 (L02,4) (SCF - Indirect Method) The following are Sullivan Corp.'s comparative balance sheet accounts at December 31, 20X2 and 20X1. Cash Accounts receivable Inventory

P22-1 (LO2, A) (SCF - Indirect Method) The following are Sullivan Corp.'s comparative balance sheet accounts at December 31, 202 and 201. Additional information: 1. The Long-term investments are equily investments purchased by Sullivan Corp. at the end of 201 for $275,000. Sullivan purchased an additional $35,000 of equity investments in 202. 2. During 202, Sullivan purchased a patent for $260,000. The Patent account was adjusted at vear-end to $250,000 to recognize amortization. 3. On January 2,202, Sullivan sold equipment costing $60,000, with a carrying amount of $38,000, for $40,000 cash. 4. On December 31, 20K2, Sullivan purchased an office bullding. Of the total purchase price, $150,000 was financed with a Mortgage Note Payable. The remainder was paid in cash. 5. Net income for 202 was $370,000. Instructions: Prepare a statement of cash flows for Sullivan Corp, for the vear ended December 31, 20X2, using the Indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts