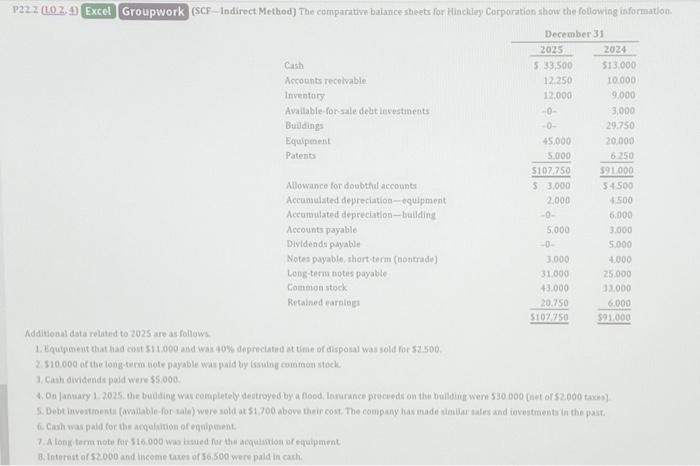

Question: P22.2 (LO 2, 4) Excel Groupwork (SCF-Indirect Method) The comparative balance sheets for Hinckley Corporation show the following information. December 31 Cash Accounts receivable Inventory

Ndditonal data related to 2025 are as follows 1. Equigenent that had coit $11.000 and war 40% degireciateil ot tinie of disposal was rold for 52.500 2. 510.000 of the long-term note payable was fald ty issuind cosomoon stock. 1. Cath dividends paid were 55,000 4, 0n lanuary 1. 2025. the buiding wak ceripletely deotroyed bya food, leirurance proceedi on thie buildicir were 530.000 (het of 52.000 taxes) 6. Cash was pald for the arquition of equighent. 7. A long tarm nete far 516.000 was iasued for than acquntoa of equipment B. foterest of 52.000 and lisceme tame of 56.500 were pald in caxh. Ndditonal data related to 2025 are as follows 1. Equigenent that had coit $11.000 and war 40% degireciateil ot tinie of disposal was rold for 52.500 2. 510.000 of the long-term note payable was fald ty issuind cosomoon stock. 1. Cath dividends paid were 55,000 4, 0n lanuary 1. 2025. the buiding wak ceripletely deotroyed bya food, leirurance proceedi on thie buildicir were 530.000 (het of 52.000 taxes) 6. Cash was pald for the arquition of equighent. 7. A long tarm nete far 516.000 was iasued for than acquntoa of equipment B. foterest of 52.000 and lisceme tame of 56.500 were pald in caxh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts