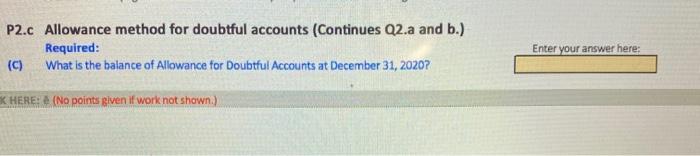

Question: P2.c Allowance method for doubtful accounts (Continues Q2.a and b.) Required: (C) What is the balance of Allowance for Doubtful Accounts at December 31, 20207

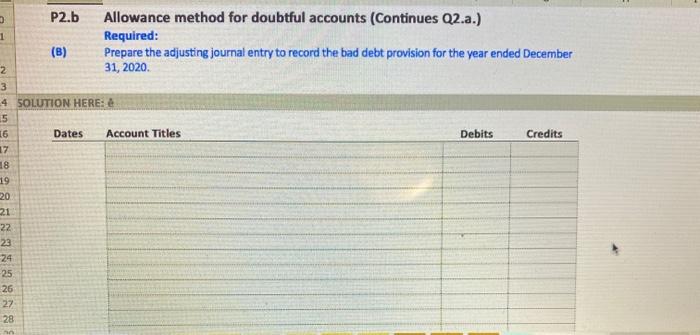

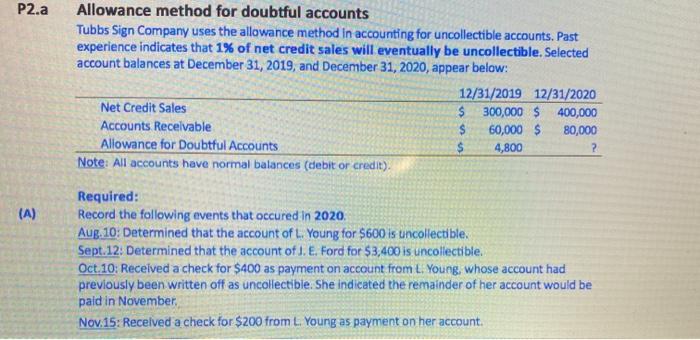

P2.c Allowance method for doubtful accounts (Continues Q2.a and b.) Required: (C) What is the balance of Allowance for Doubtful Accounts at December 31, 20207 Enter your answer here: K HERE: (No points given if work not shown.) 1 P2.b Allowance method for doubtful accounts (Continues 02.a.) Required: (B) Prepare the adjusting journal entry to record the bad debt provision for the year ended December 2 31, 2020 3 4 SOLUTION HERE: 15 16 Dates Account Titles Debits Credits 17 18 19 20 21 22 23 24 -25 26 27 28 ho P2.a Allowance method for doubtful accounts Tubbs Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 1% of net credit sales will eventually be uncollectible. Selected account balances at December 31, 2019, and December 31, 2020, appear below: 12/31/2019 12/31/2020 Net Credit Sales $ 300,000 $ 400,000 Accounts Receivable $ 60,000 $ 80,000 Allowance for Doubtful Accounts $ 4,800 Note: All accounts have normal balances (debit or credit). Required: Record the following events that occured in 2020 Aug 10: Determined that the account of L. Young for $600 is uncollectible. Sept.12: Determined that the account of I. E. Ford for $3,400 is uncollectible. Oct.10: Received a check for $400 as payment on account from L. Young, whose account had previously been written off as uncollectible. She indicated the remainder of her account would be paid in November Nov. 15: Received a check for $200 from L. Young as payment on her account. (A)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts