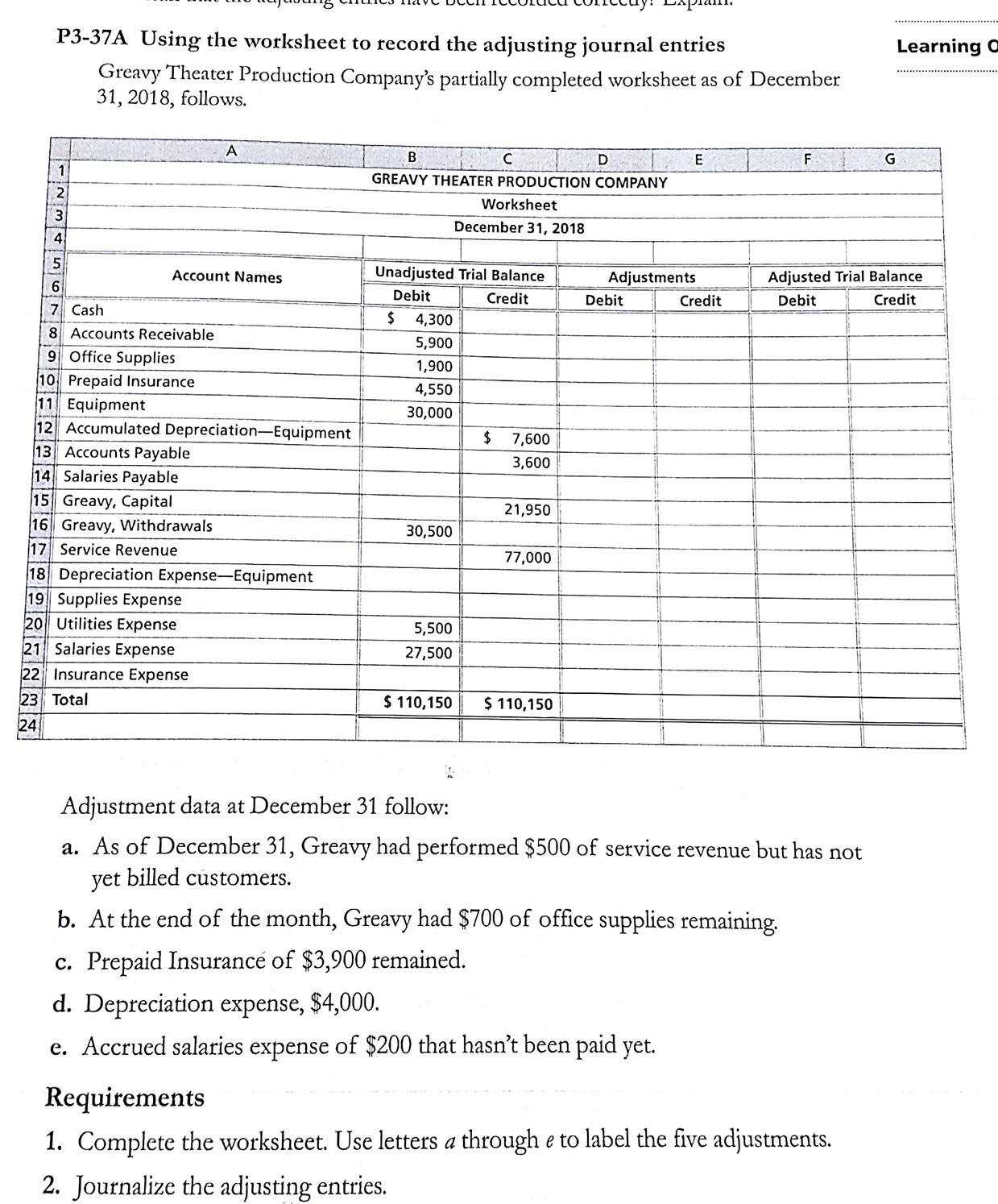

Question: P3-37A Using the worksheet to record the adjusting journal entries Learning Greavy Theater Production Company's partially completed worksheet as of December 31, 2018, follows. A

P3-37A Using the worksheet to record the adjusting journal entries Learning Greavy Theater Production Company's partially completed worksheet as of December 31, 2018, follows. A B C D E F G GREAVY THEATER PRODUCTION COMPANY Worksheet December 31, 2018 IN Ou A WIN- Account Names Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit Debit Credit $ 4,300 8 Accounts Receivable ;,900 9 Office Supplies 1,900 10 Prepaid Insurance 4,550 11 Equipment 80,000 12 Accumulated Depreciation-Equipment $ 7,600 13 Accounts Payable 3,600 14 Salaries Payable 15 Greavy, Capital 21,950 16 Greavy, Withdrawals 30,500 17 Service Revenue 77,000 18 Depreciation Expense-Equipment 19 Supplies Expense 20 Utilities Expense 5,500 21 Salaries Expense 27,500 22| Insurance Expense 23 Total $ 110, 150 $ 110,150 24 Adjustment data at December 31 follow: a. As of December 31, Greavy had performed $500 of service revenue but has not yet billed customers. b. At the end of the month, Greavy had $700 of office supplies remaining. c. Prepaid Insurance of $3,900 remained. d. Depreciation expense, $4,000. e. Accrued salaries expense of $200 that hasn't been paid yet. Requirements 1. Complete the worksheet. Use letters a through e to label the five adjustments. 2. Journalize the adjusting entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts