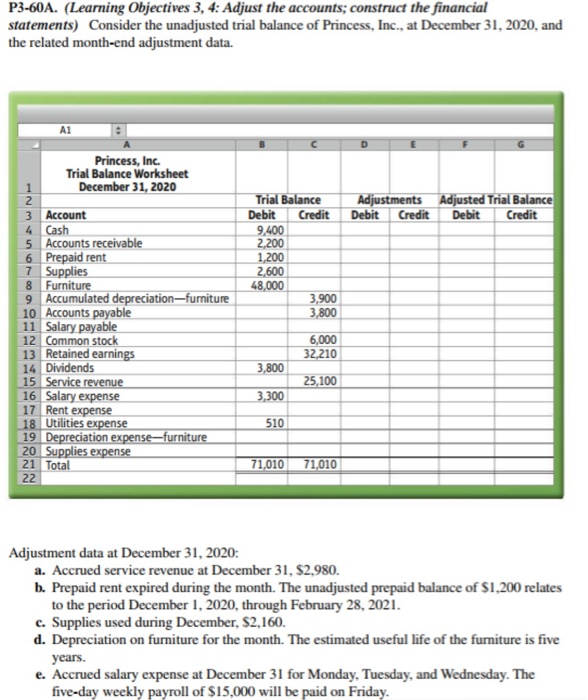

Question: P3-60A. (Learning Objectives 3, 4: Adjust the accounts; construct the financial statements) Consider the unadjusted trial balance of Princess, Inc., at December 31, 2020, and

P3-60A. (Learning Objectives 3, 4: Adjust the accounts; construct the financial statements) Consider the unadjusted trial balance of Princess, Inc., at December 31, 2020, and the related month-end adjustment data. A1 Princess, Inc. Trial Balance Worksheet December 31, 2020 Trial Balance 2 3 Account 4 Cash 5 Accounts receivable 6 Prepaid Debit CreditDebitCredit Debit Credit 9,400 2,200 2,600 8 Furniture 9 Accumulated depreciat 10 Accounts payable 11 Salary paya 12 Common stock 13 Retained earnin 14 Dividends 15 16 Salary 17 Rent expense 3,900 3,800 ure 6,000 10 100 19 20 21 T Adjustment data at December 31, 2020: a. Accrued service revenue at December 31, $2,980. b. Prepaid rent expired during the month. The unadjusted prepaid balance of S1,200 relates to the period December 1, 2020, through February 28, 2021 e. Supplies used during December, $2,160. d. Depreciation on furniture for the month. The estimated useful life of the furniture is five years. e. Accrued salary expense at December 31 for Monday. Tuesday, and Wednesday. The five-day weekly payroll of $15,000 will be paid on Friday

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts