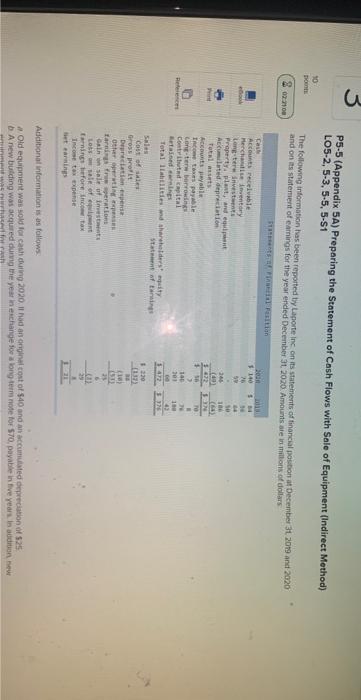

Question: P5.5 (Appendix 5A) Preparing the Statement of Cash Flows with Sale of Equipment (Indirect Method) LO5-2, 5-3, 5-5,5-S1 The following information has been repoited ty

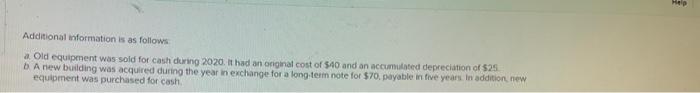

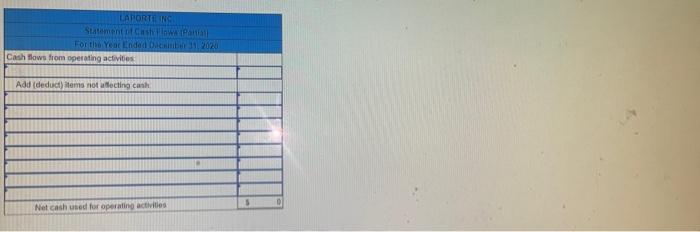

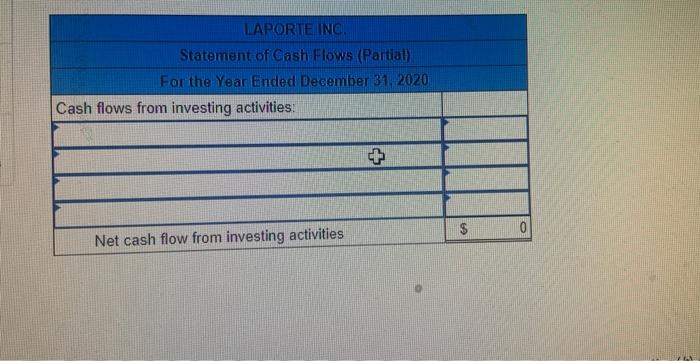

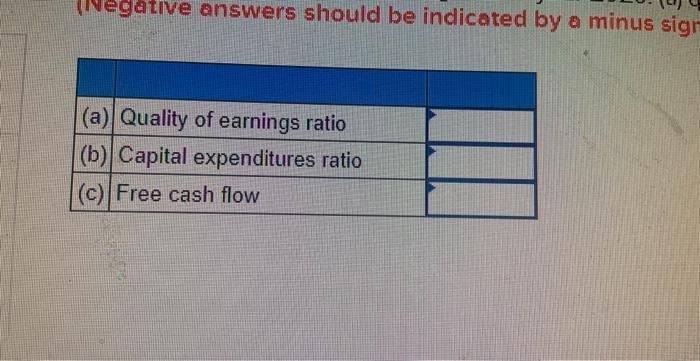

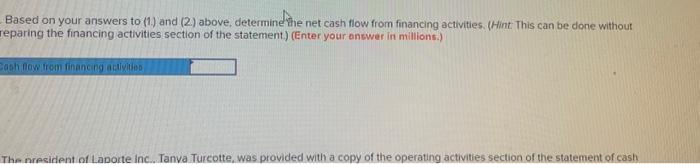

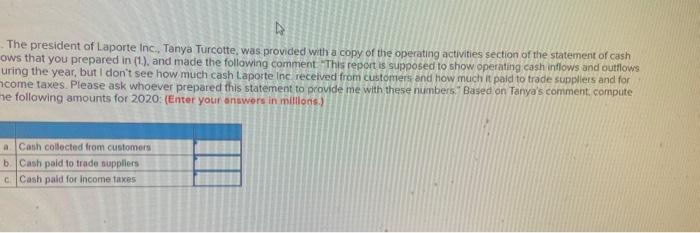

P5.5 (Appendix 5A) Preparing the Statement of Cash Flows with Sale of Equipment (Indirect Method) LO5-2, 5-3, 5-5,5-S1 The following information has been repoited ty taporte Inc on its stateinents of tinanchal poition at December 31.20. 2 and 2020 and on ats statement of eamings for the year ended December 91,2020 . Amounts ate in miltons of dollars Additional informanion is as follows. b. A new busting was acque ed oding the year in evehange foe a bing term note for 570 , payable hifive years. la additun new Additional thformation is as follows: a. Old equipenent was soid for cash dering 2020. It had an orighal cost of $40 and an accumulated depreciation of $25 b. A riew building was acquired during the year in exchange for a long tein note for 570 . payable in five years. in addition new equipenent was purchased for cash. Tivegative answers should be indicated by a minus sign Based on your answers to (1.) and (2.) above, determine the net cash flow from financing activities. (Hint: This can be done without paring the financing activities section of the statement) (Enter your answer in millions.) The president of Laporte Inc. Tanya Turcotte, was provided with a copy of the operating activities section of the statement of cash ows that you prepared in (1). and made the following comment. Thys report is supposed to show operating cash inflows and outflows uring the year, but I don't see how much cash Laporte inc received from customert and how much it paid to trade suppliers and for icome taxes. Please ask whoever prepared this statement to provide me with these numbers." Based on Tanya's comment compute he following amounts for 2020: (Enter your onswers in millions.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts