Question: P5-72B. (Learning Objectives 1, 2, 3, 4, 5: Apply GAAP for proper revenue recognition; account for sales allowances; account for sales discounts; account for accounts

P5-72B. (Learning Objectives 1, 2, 3, 4, 5: Apply GAAP for proper revenue recognition; account for sales allowances; account for sales discounts; account for accounts receivable; write off account; estimate uncollectible account expense)

Baker Variety Store had the following balances as of November 1:

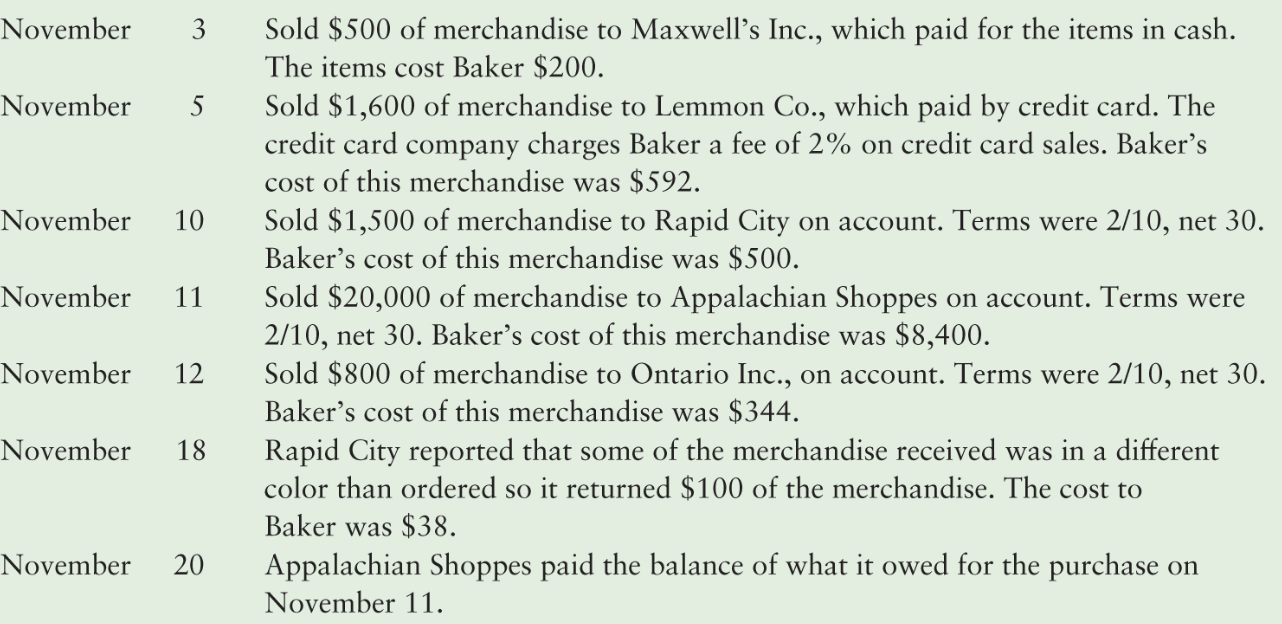

The following selected transactions occurred at Baker Variety Store during the month of November:

Requirements

Record Bakers November transactions, including the cost of goods sold entries for each sale.

Calculate the net realizable value of accounts receivable as of November 30.

November 3 Sold $500 of merchandise to Maxwell's Inc., which paid for the items in cash. The items cost Baker $200. November 5 Sold $1,600 of merchandise to Lemmon Co., which paid by credit card. The credit card company charges Baker a fee of 2% on credit card sales. Baker's cost of this merchandise was $592. November 10 Sold $1,500 of merchandise to Rapid City on account. Terms were 2/10, net 30 . Baker's cost of this merchandise was $500. November 11 Sold $20,000 of merchandise to Appalachian Shoppes on account. Terms were 2/10, net 30 . Baker's cost of this merchandise was $8,400. November 12 Sold $800 of merchandise to Ontario Inc., on account. Terms were 2/10, net 30 . Baker's cost of this merchandise was $344. November 18 Rapid City reported that some of the merchandise received was in a different color than ordered so it returned $100 of the merchandise. The cost to Baker was $38. November 20 Appalachian Shoppes paid the balance of what it owed for the purchase on November 11. November 3 Sold $500 of merchandise to Maxwell's Inc., which paid for the items in cash. The items cost Baker $200. November 5 Sold $1,600 of merchandise to Lemmon Co., which paid by credit card. The credit card company charges Baker a fee of 2% on credit card sales. Baker's cost of this merchandise was $592. November 10 Sold $1,500 of merchandise to Rapid City on account. Terms were 2/10, net 30 . Baker's cost of this merchandise was $500. November 11 Sold $20,000 of merchandise to Appalachian Shoppes on account. Terms were 2/10, net 30 . Baker's cost of this merchandise was $8,400. November 12 Sold $800 of merchandise to Ontario Inc., on account. Terms were 2/10, net 30 . Baker's cost of this merchandise was $344. November 18 Rapid City reported that some of the merchandise received was in a different color than ordered so it returned $100 of the merchandise. The cost to Baker was $38. November 20 Appalachian Shoppes paid the balance of what it owed for the purchase on November 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts