Question: P6-24 and P6-16 CHAPTER 6 Interest Rates and Bond Valuation 287 P6-16 Bond valuation: Annual interest Calculate the value of each of the bonds shown

P6-24 and P6-16

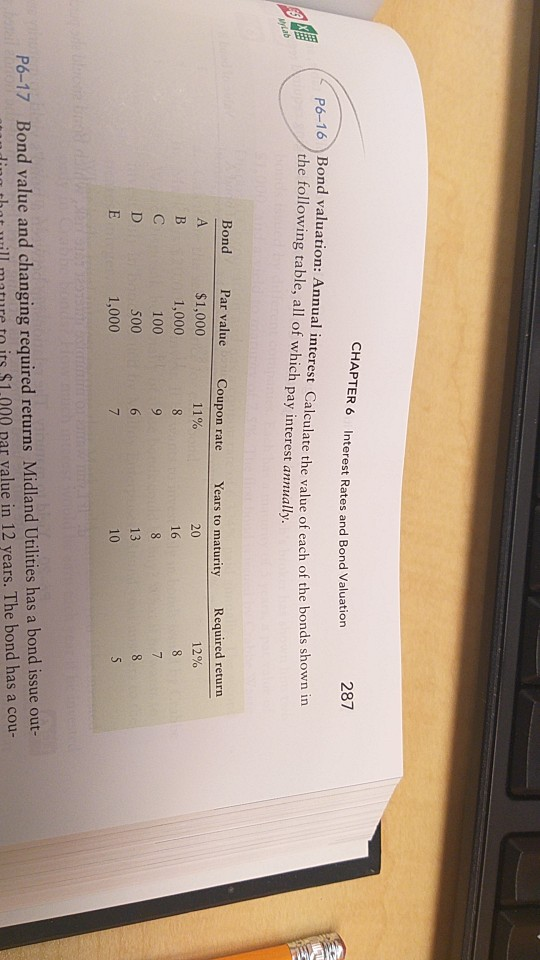

CHAPTER 6 Interest Rates and Bond Valuation 287 P6-16 Bond valuation: Annual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest annually Bond Par valueCoupon rate Yea Required return 12% rs to maturity $1,000 1,000 100 500 1,000 11% 1 20 16 13 10 P6-17 Bond value and changing required returns Midland Utilities has a bond issue out- Il matur to irs $1.000 par yalue in 12 years. The bond has a c est only in bonds issued by Crabbe invest only in bonds issued by Malfoy Enterprises? Round your answers bonds could he buy? What if he wants to nearest integer What is the total interest income that Mark could earn each year if he c. invested only in Crabbe bonds? How much interest would he earn each year i only in Malfoy bonds? Assume that Mark will reinvest all the interest he receives as it is paid, and his rate of return on reinvested interest will be 10%. Calculate the total dollars that Mark will accumulate over 5 years if he invests in Crabbe bonds or Malfoy bonds. Your total dollar calculation will include the interest Mark gets, the prhl cipal he receives when the bonds mature, and all the additional interest he earns from reinvesting the coupon payments that he receives d. e. The bonds issued by Crabbe and Malfoy might appear to be equally good invest- ments because they offer the same yield to maturity of 7.5%. Notice, however, that your answers to part d are not the same for each bond, suggesting that one bond is a better investment than the other. Why is that the case? Bond valuation: Semiannual interest Find the value of a bond maturing in 6 years, with a $1,000 par value and a coupon rate of 10% (5% paid semiannually) if the required return on similar-risk bonds is 14% per year (7% paid semiannually) P6-24 nual interest Calculate the value of each of the bonds shown P6-25 Bond valuation: Semian

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts