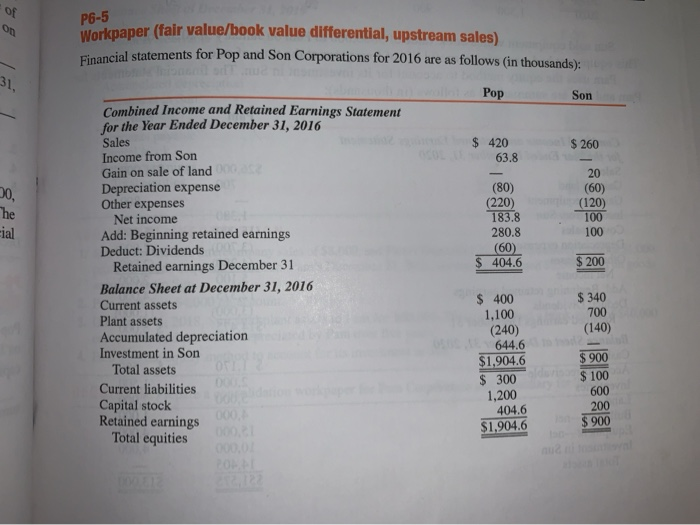

Question: P6-5 snaper (fair value/book value differential, upstream sales) ancial statements for Pop and Son Corporations for 2016 are as follows (in thousands) Pop Son $

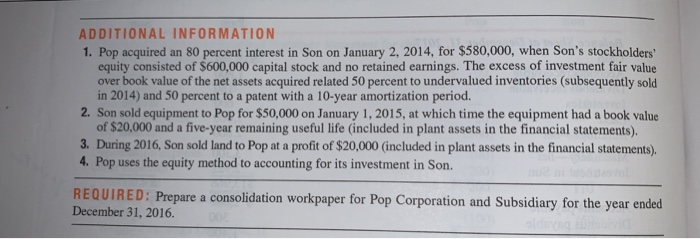

P6-5 snaper (fair value/book value differential, upstream sales) ancial statements for Pop and Son Corporations for 2016 are as follows (in thousands) Pop Son $ 420 63.8 $ 260 (80) (220) 183.8 280.8 (60) $ 404.6 20 (60) (120) 100 100 $ 200 Combined Income and Retained Earnings Statement for the Year Ended December 31, 2016 Sales Income from Son Gain on sale of land Depreciation expense Other expenses Net income Add: Beginning retained earnings Deduct: Dividends Retained earnings December 31 Balance Sheet at December 31, 2016 Current assets Plant assets Accumulated depreciation Investment in Son Total assets Current liabilities Capital stock Retained earnings Total equities $ 340 700 (140) $ 900 $ 400 1,100 (240) 644.6 $1,904.6 $ 300 1,200 404.6 $1,904.6 600 000 200 $ 900 ADDITIONAL INFORMATION 1. Pop acquired an 80 percent interest in Son on January 2, 2014, for $580,000, when Son's stockholders equity consisted of $600,000 capital stock and no retained earnings. The excess of investment fair value over book value of the net assets acquired related 50 percent to undervalued inventories (subsequently sold in 2014) and 50 percent to a patent with a 10-year amortization period. 2. Son sold equipment to Pop for $50,000 on January 1, 2015, at which time the equipment had a book value of $20,000 and a five-year remaining useful life (included in plant assets in the financial statements). 3. During 2016, Son sold land to Pop at a profit of $20,000 (included in plant assets in the financial statements). 4. Pop uses the equity method to accounting for its investment in Son. REQUIRED: Prepare a consolidation workpaper for Pop Corporation and Subsidiary for the year ended December 31, 2016

Step by Step Solution

There are 3 Steps involved in it

To prepare the consolidation workpaper for Pop Corporation and its subsidiary for the year ended December 31 2016 follow these steps Step 1 Determine ... View full answer

Get step-by-step solutions from verified subject matter experts