Question: P6-6 Determining Bad Debt Expense Based on Aging Analysis and Interpreting Ratios LO6-4 Please answer all questions in the pics :) P6-6 Determining Bad Debt

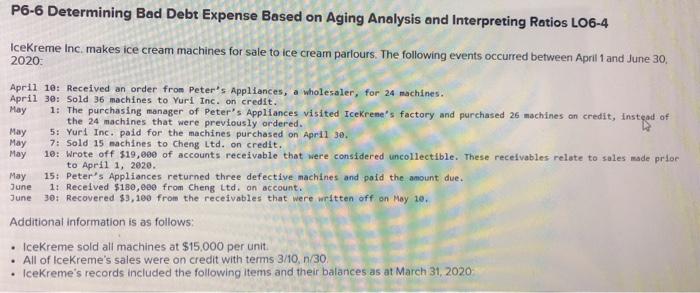

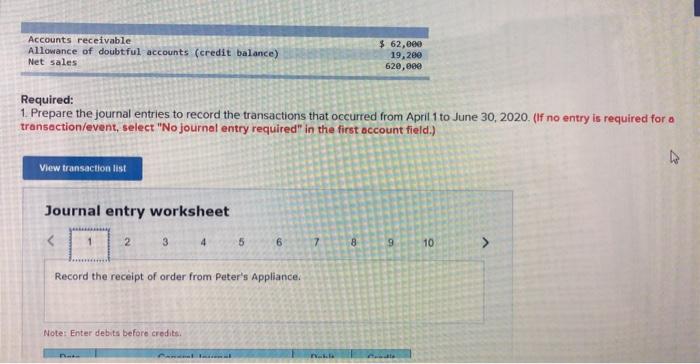

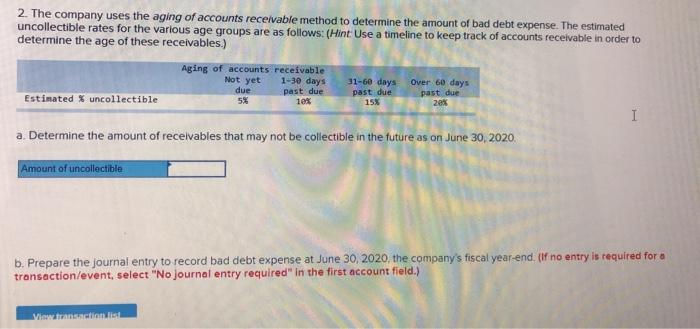

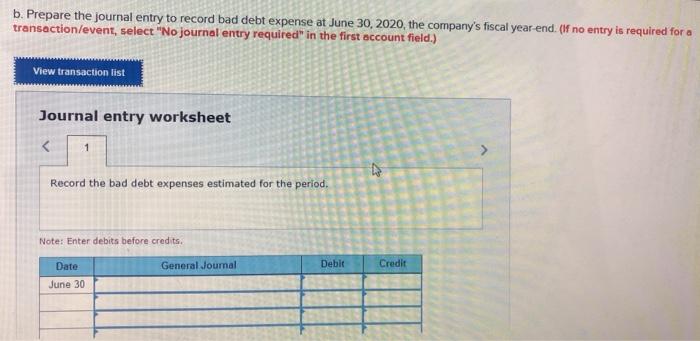

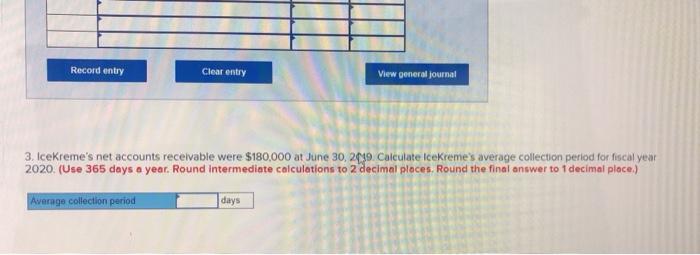

P6-6 Determining Bad Debt Expense Based on Aging Analysis and Interpreting Ratios L06-4 IceKreme Inc. makes ice cream machines for sale to ice cream parlours. The following events occurred between April 1 and June 30, 2020 May April 10: Received an order from Peter's Appliances, a wholesaler, for 24 machines. April 30: Sold 36 machines to Yuri Inc. on credit. May 1: The purchasing manager of Peter's Appliances visited Icekrene's factory and purchased 26 machines on credit, Instead of the 24 machines that were previously ordered. 5: Yuri Inc. paid for the machines purchased on April 30. May 7: Sold 15 machines to Cheng Ltd. on credit. May 10: wrote off $19,000 of accounts receivable that were considered uncollectible. These receivables relate to sales made prior to April 1, 2020. May 15: Peter's Appliances returned three defective machines and paid the amount due. June 1: Received $180,000 from Cheng Ltd. on account. June 30: Recovered $3,100 from the receivables that were written off on May 10. Additional information is as follows: IceKreme sold all machines at $15,000 per unit All of IceKreme's sales were on credit with terms 3/10, n/30 IceKreme's records included the following items and their balances as at March 31, 2020 Accounts receivable Allowance of doubtful accounts (credit balance) Net sales $ 62,000 19,200 620,eee Required: 1. Prepare the journal entries to record the transactions that occurred from April to June 30, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts