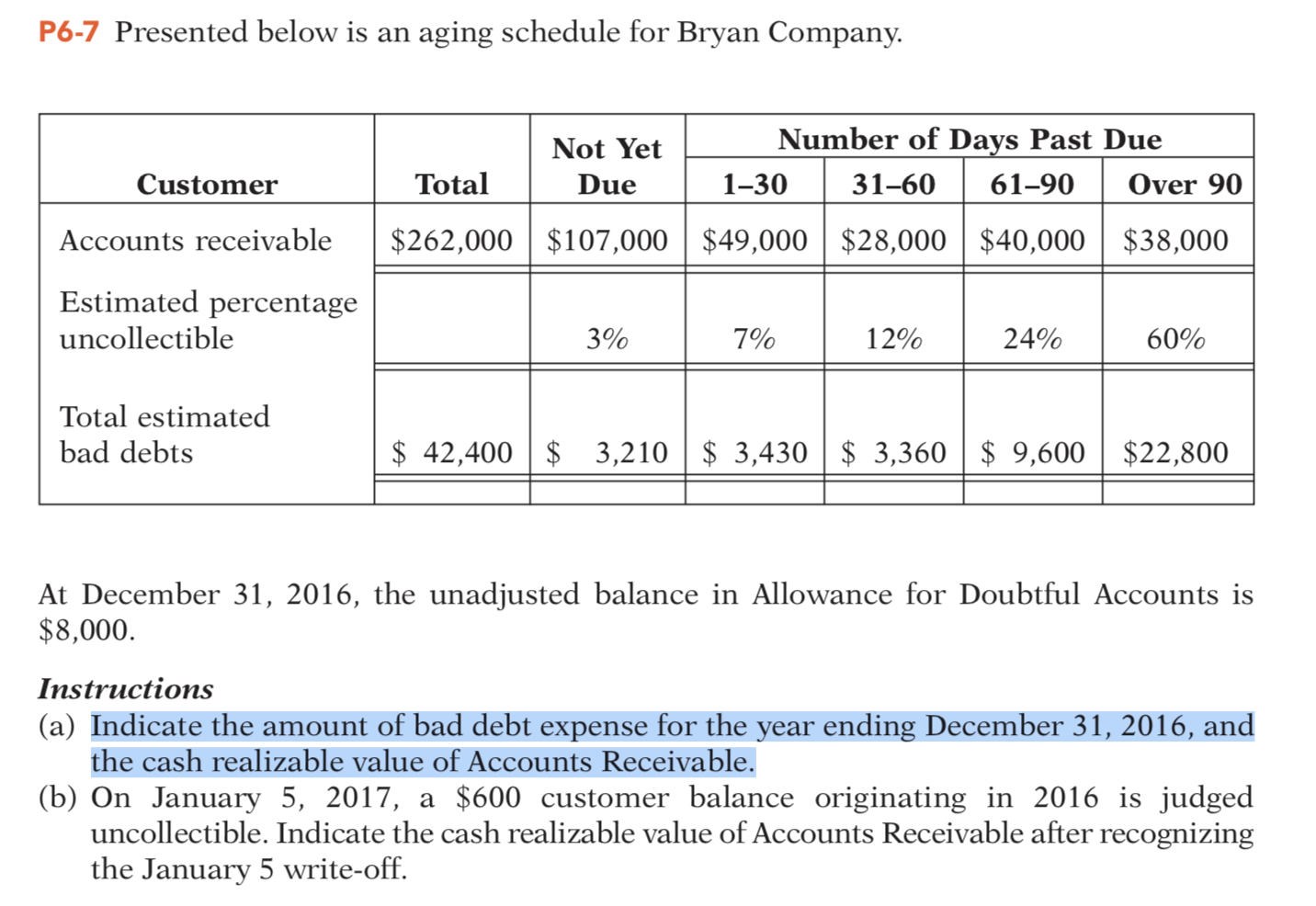

Question: P6-7 Presented below is an aging schedule for Bryan Company. Customer Total $262,000 Not Yet Number of Days Past Due Due | 1-30 31-60 |

P6-7 Presented below is an aging schedule for Bryan Company. Customer Total $262,000 Not Yet Number of Days Past Due Due | 1-30 31-60 | 61-90 | Over 90 $107,000 $49,000 $28,000 $40,000 $38,000 Accounts receivable Estimated percentage uncollectible 3% 7% 12% 24% | 60% Total estimated bad debts $ 42,400 $ 3,210 $ 3,430 $ 3,360 $ 9,600 $22,800 At December 31, 2016, the unadjusted balance in Allowance for Doubtful Accounts is $8,000. Instructions (a) Indicate the amount of bad debt expense for the year ending December 31, 2016, and the cash realizable value of Accounts Receivable. (b) On January 5, 2017, a $600 customer balance originating in 2016 is judged uncollectible. Indicate the cash realizable value of Accounts Receivable after recognizing the January 5 write-off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts