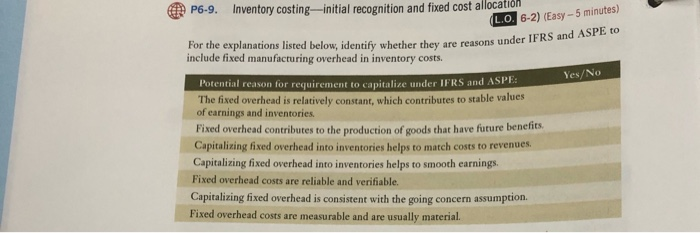

Question: P6-9. Inventory costing-initial recognition and fixed cost allocation For the explanations listed below, identify whether they are reasons und include fixed manufacturing overhead in inventory

P6-9. Inventory costing-initial recognition and fixed cost allocation For the explanations listed below, identify whether they are reasons und include fixed manufacturing overhead in inventory costs. L.O. 6-2) (Easy - 5 minutes) low, identify whether they are reasons under IFRS and ASPE to Yes/No Potential reason for requirement to capitalize under IFRS and ASPE: The fixed overhead is relatively constant, which contributes to stable values of earnings and inventories. Fixed overhead contributes to the production of goods that have future benents Capitalizing fixed overhead into inventories helps to match costs to revenues. Capitalizing fixed overhead into inventories helps to smooth earnings. Fixed overhead costs are reliable and verifiable. Capitalizing fixed overhead is consistent with the going concern assumption. Fixed overhead costs are measurable and are usually material

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts