Question: P7-14 Common stock value: Variable Growth Common stock value: Variable growth Home Place Hotels Inc. is entering into a 3-year remodeling and expansion project. The

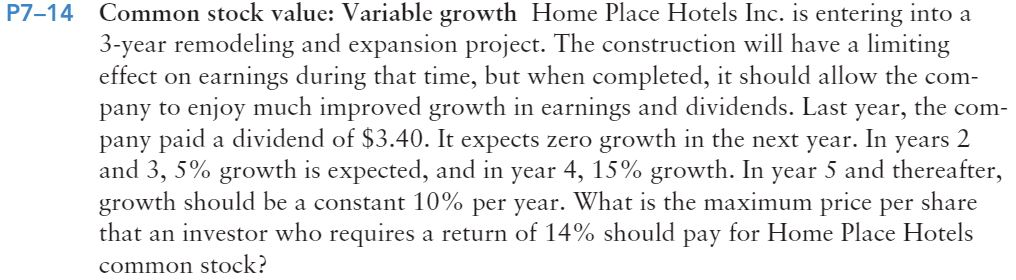

P7-14 Common stock value: Variable Growth

Common stock value: Variable growth Home Place Hotels Inc. is entering into a 3-year remodeling and expansion project. The construction will have a limiting effect on earnings during that time, but when completed, it should allow the com pany to enjoy much improved growth in earnings and dividends. Last year, the com pany paid a dividend of $3.40. It expects zero growth in the next year. In years 2 and 3,5% growth is expected, and in year 4, 15% growth. In year 5 and thereafter. growth should be a constant 10% per year. What is the maximum price per share that an investor who requires a return of 14% should pay for Home Place Hotels common stock? P7-14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts