Question: p7-25 (2) A decrease in its risk premium to 4%. 25 ETHICS PROBLEM Melissa is trying to value the stock of Generic Utility Inc P7-25

p7-25

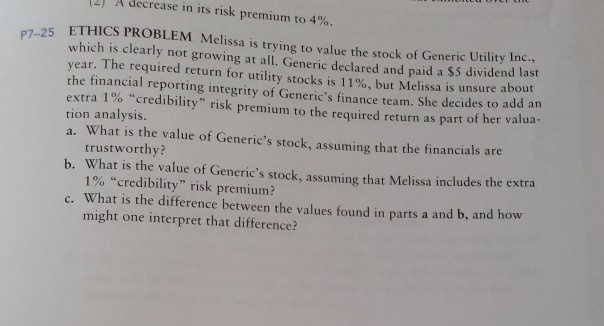

(2) A decrease in its risk premium to 4%. 25 ETHICS PROBLEM Melissa is trying to value the stock of Generic Utility Inc P7-25 which is clearly not growing at all. Generic declared and paid a $5 dividend last r. The required return for utility stocks is 11%, but Melissa is unsure the financial reporting integrity of Generic's finance team. She decides to add an extra 1% "credibility" risk premium to the required return as part of her valua- tion analysis a. What is the value of Generie's stock, assuming that the financials are about trustworthy? 190 "credibility" risk premium? might one interpret that difference? What o the dierne berween the valusoundin parts a and b, and how

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts