Question: P8-13 (similar to) Question Help Portfolio return and standard deviation Personal Finance Problem Jamie Wong is thinking of building an investment portfolio containing two stocks,

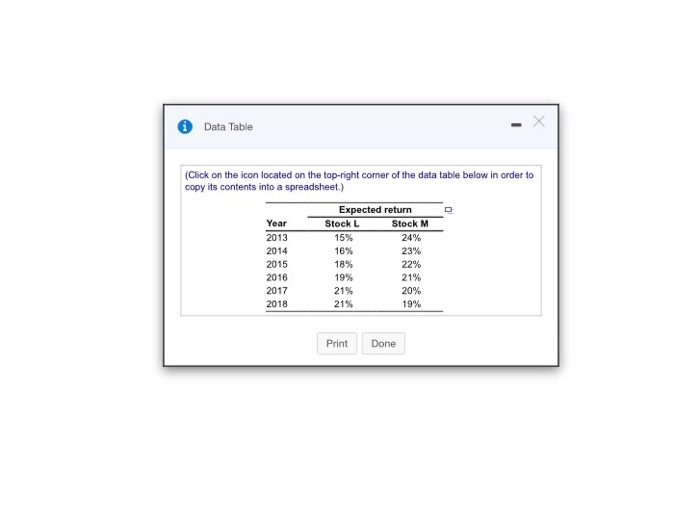

P8-13 (similar to) Question Help Portfolio return and standard deviation Personal Finance Problem Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 25% of the dollar value of the portfolio, and stock M will account for the other 75%. The historical retums over the next 6 years, 2013-20 for each of these stocks are shown in the following table: a. Calculate the actual portfolio return, p: for each of the 6 years. b. Calculate the expected value of portfolio returns, p over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, o,i' over the 6-year period. d. How would you characterize the correlation of retums of the two stocks L and M? e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts