Question: P8-26 (similar to) Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find

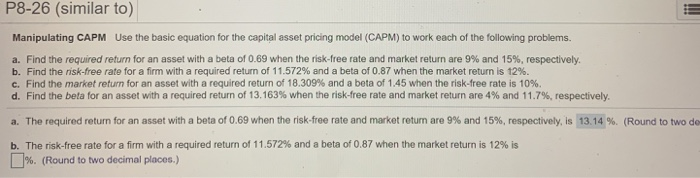

P8-26 (similar to) Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find the required return for an asset with a beta of 0.69 when the risk-free rate and market return are 9% and 15%, respectively. b. Find the nisk-free rate for a firm with a required return of 11.572% and a beta of 0.87 when the market return is 12%. C. Find the market return for an asset with a required return of 18.309% and a beta of 1.45 when the risk-free rate is 10% d. Find the beta for an asset with a required return of 13.163% when the risk-free rate and market return are 4% and 11.7%, respectively. a. The required return for an asset with a beta of 0.69 when the risk-free rate and market return are 9% and 15%, respectively, is 13.14 %. (Round to two de b. The risk-free rate for a firm with a required return of 11.572% and a beta of 0.87 when the market return is 12% is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts