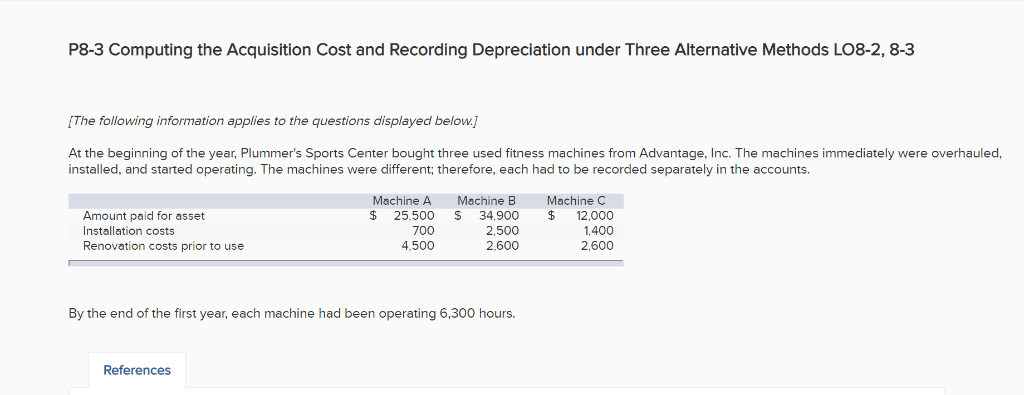

Question: P8-3 Computing the Acquisition Cost and Recording Depreciation under Three Alternative Methods LO8-2, 8-3 The following information applies to the questions displayed below.j At the

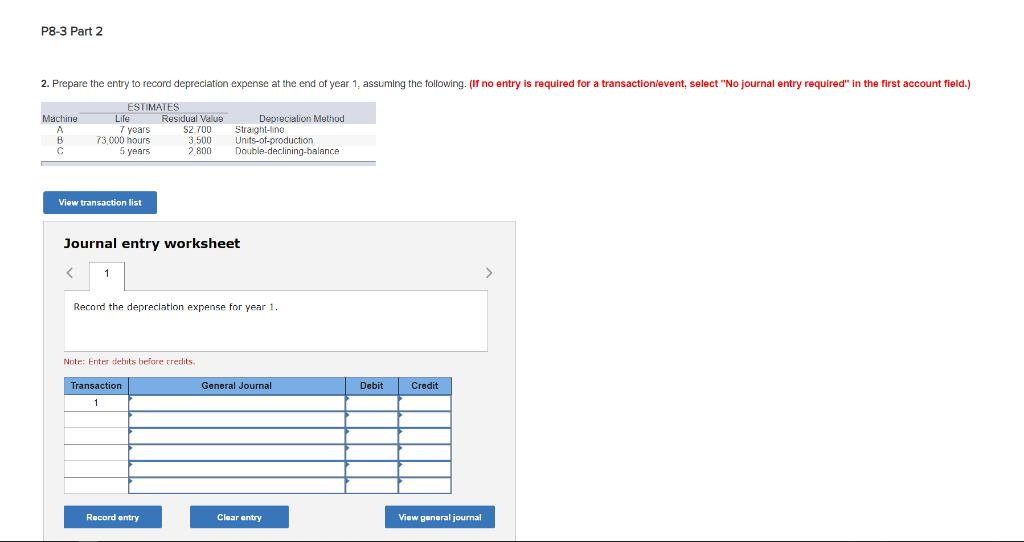

P8-3 Computing the Acquisition Cost and Recording Depreciation under Three Alternative Methods LO8-2, 8-3 The following information applies to the questions displayed below.j At the beginning of the year, Plummer's Sports Center bought three used fitness machines from Advantage, Inc. The machines immediately were overhauled, installed, and started operating. The machines were different; therefore, each had to be recorded separately in the accounts. Machine A Machine B Machine Amount paid for asset Installation costs Renovation costs prior to use $ 25.500 34,900 $ 12.000 2,500 2,600 700 4,500 1,400 2,600 By the end of the first year, each machine had been operating 6,300 hours. References P8-3 Part 2 2. Prepare the entry to record depreciation expense at the end of year 1, assuming the tollowing. (If no entry is required for a transactionievent, select "No journal entry required" in the first account field.) ESTIMATES Machine Residual Value 7 years 73,000 hours 5 years 52,700 Straght-line 3,500 Units-of-production 2800 Double-declining-balance View transaction list Journal entry worksheet Record the depreclation expense for year 1. Note: Enter debits befare credits. General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts